NetFlix 2003 Annual Report Download - page 28

Download and view the complete annual report

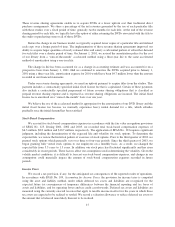

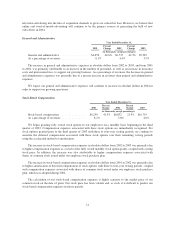

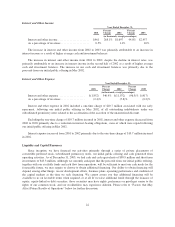

Please find page 28 of the 2003 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.our existing subscribers in accordance with our business plans. An increase in subscriber churn may

signal a deterioration in the quality of our service, or it may signal an unfavorable behavioral change in

the mix of new subscribers. Lower subscriber churn means higher customer retention, faster revenue

growth and lower marketing expenses as a percent of revenues for any given level of subscriber

acquisition.

•Subscriber Acquisition Cost: Subscriber acquisition cost is defined as total marketing expense divided

by total gross subscriber additions. Management reviews this metric closely to evaluate how effective

our marketing programs are in acquiring new subscribers on an economical basis.

•Disc Usage Per Paying Subscriber: Disc usage per paying subscriber is calculated as the total number

of shipments to paying subscribers divided by the number of average paying subscribers. Management

considers this metric important because of its direct impact on gross margin. Since our subscribers can

rent an unlimited number of DVDs for a fixed monthly subscription fee, an increase in disc usage per

paying subscriber in a given period translates into higher revenue sharing and postage and packaging

expenses while subscription revenues remain unchanged, which results in an adverse impact on gross

margin. Although gross margin is driven down, higher disc usage can improve subscriber satisfaction,

reduce subscriber churn and increase the lifetime value of each subscriber.

•Gross Margin: Management reviews gross margin in conjunction with subscriber churn and

subscriber acquisition cost to target a desired operating margin. For example, disc usage may increase,

which depresses our gross margin. However, increased disc usage may result in higher subscriber

satisfaction, which reduces subscriber churn and increases word-of-mouth advertising about our service.

As a result, marketing expense may fall as a percent of revenues and operating margins rise, offsetting

the impact of a reduction in gross margin. We can also make trade-offs between our DVD library

investments which have an inverse relationship with subscriber churn and subscriber acquisition cost.

For example, an increase in our DVD library investments may improve customer satisfaction and lower

subscriber churn, and hence increase the number of new subscribers acquired via word-of-mouth. This

in turn allows us to invest less in marketing activities.

Please see “Results of Operations” below for further discussion on these key business metrics.

New Initiatives in 2004

Looking ahead, we will continue to focus on our online DVD rental subscription service in the United

States. We will continue to make steady improvements in our service driving what we refer to as the “virtuous

cycle”: Our continued service improvements create high subscriber satisfaction, which results in lower subscriber

churn and positive word-of-mouth about our service. This in turn helps us grow our subscriber base faster. As we

grow, we continue to make more improvements to our service, which drives the cycle again.

In addition to our core focus, we are planning on executing the following new initiatives in 2004:

• First, we are preparing to expand operations internationally. Our first international markets will likely be

in the United Kingdom and/or Canada. Although both countries are good expansion markets for us, we

believe international operations will, over time, contribute less than 20 percent of our revenues as the

U.S. market continues to grow.

• Second, we are working on developing solutions for downloading movies to consumers. Our core

strategy has been and remains to grow a large DVD subscription business; however, as technology and

infrastructure develop to allow effective and convenient delivery of movies over the Internet, we intend

to offer our subscribers the choice under one subscription of receiving their movies on DVD or by

downloading, whichever they prefer. Although 2004 will be early for downloading and we expect only

modest consumer interest initially, we believe it will grow steadily over the next ten years.

12