NetFlix 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Descriptions of Statement of Operations Components

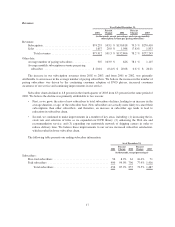

Subscription Revenues:

We generate all our revenues in the United States. We derive substantially all of our revenues from monthly

subscription fees and recognize subscription revenues ratably during each subscriber’s monthly subscription

period. We record refunds to subscribers as a reduction of revenues. In addition to our standard services of

$19.95 per month, we offer other service plans with different price points that allow subscribers to keep either

fewer or more titles at the same time. As of December 31, 2003, more than 92 percent of our paying subscribers

paid $19.95 or more per month.

Cost of Subscription Revenues:

We acquire titles for our library through traditional direct purchase and revenue sharing agreements.

Traditional buying methods normally result in higher upfront costs than titles obtained through revenue sharing

agreements. Cost of subscription revenues consists of revenue sharing expenses, amortization of our library,

amortization of intangible assets related to equity instruments issued to certain studios in 2000 and 2001 and

postage and packaging costs related to shipping titles to paying subscribers. Costs related to free-trial subscribers

are allocated to marketing expenses.

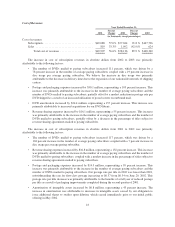

Revenue Sharing Expenses. Our revenue sharing agreements generally commit us to pay an initial upfront

fee for each DVD acquired. Revenue sharing expenses are recorded as DVDs subject to revenue sharing

agreements are shipped to subscribers. Under certain of our revenue sharing agreements, we pay an additional

minimum revenue sharing fee for each DVD shipped to a subscriber. Other than the initial upfront payment for

DVDs acquired, we are not obligated to pay any minimum revenue sharing fee on DVDs that are not shipped to

subscribers. We characterize these payments to the studios as revenue sharing expenses.

Amortization of DVD Library. On January 1, 2001, we shortened the estimated life of DVD library to one

year and assumed a salvage value of $2.00 for the DVDs that we believe we will eventually sell. Prior to

January 1, 2001, we amortized our cost of DVDs using a “sum-of-the-month” accelerated method over an

estimated life of three years and assumed no salvage value.

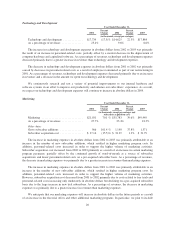

Amortization of Intangible Assets. In 2000, in connection with signing revenue sharing agreements with

Columbia TriStar Home Entertainment, Dreamworks International Distribution and Warner Home Video, we

agreed to issue to each of these studios our Series F Non-Voting Preferred Stock equal to 1.204 percent of our

fully diluted equity securities outstanding. In 2001, in connection with signing revenue sharing agreements with

Twentieth Century Fox Home Entertainment and Universal Studios Home Video, we agreed to issue to each of

the two studios our Series F Non-Voting Preferred Stock equal to 1.204 percent of our fully diluted equity

securities outstanding. As of December 31, 2001, the aggregate of Series F Non-Voting Preferred Stock granted

to these five studios equaled 6.02 percent of our fully diluted equity securities outstanding. Our obligation to

maintain the studios’ equity interests at 6.02 percent of our fully diluted equity securities outstanding terminated

immediately prior to our initial public offering in May 2002. The studios’ Series F Preferred Stock automatically

converted into 3,192,830 shares of common stock upon the closing of our initial public offering. We measured

the original issuances and any subsequent adjustments using the fair value of the securities at the issuance and

any subsequent adjustment dates. The fair value was recorded as an intangible asset and is amortized to cost of

subscription revenues ratably over the remaining term of the agreements which initial terms were either three or

five years.

Postage and Packaging. Postage and packaging expenses consist of the postage costs to mail titles to and

from our paying subscribers and the packaging and label costs for the mailers. The rate for first-class postage was

$0.34 prior to June 29, 2002 and increased to $0.37 thereafter.

13