NetFlix 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

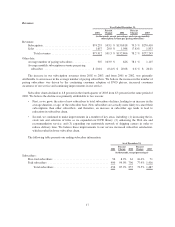

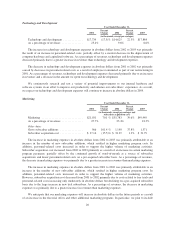

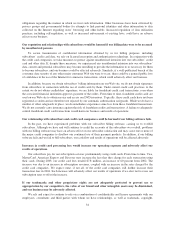

Contractual Obligations

We had no material commitments for capital expenditures as of December 31, 2003. We have obligations

under non-cancelable operating leases and capital leases with various expiration dates through 2006. Future

minimum lease payments under these leases are as follows:

Year Ending December 31,

Capital

Leases

Operating

Leases

(in thousands)

2004 ............................................................... $462 $3,592

2005 ............................................................... 55 2,076

2006 ............................................................... — 175

Total .......................................................... $517 $5,843

Off-Balance Sheet Arrangements

As part of our ongoing business, we do not engage in transactions that generate relationships with

unconsolidated entities or financial partnerships, such as entities often referred to as structured finance or special

purpose entities. Accordingly, our operating results, financial condition and cash flows are not subject to off-

balance sheet risks.

Indemnifications

In the ordinary course of business, we enter into contractual arrangements under which we agree to provide

indemnifications of varying scope and terms to business partners and other parties with respect to certain matters,

including, but not limited to, losses arising out of our breach of such agreements and out of intellectual property

infringement claims made by third parties. In addition, we have entered into indemnification agreements with our

directors and certain of our officers that will require us, among other things, to indemnify them against certain

liabilities that may arise by reason of their status or service as directors or officers.

The terms of such obligations vary. Generally, a maximum obligation is not explicitly stated, so the overall

maximum amount of the obligations cannot be reasonably estimated. To date, we have not incurred material

costs as a result of such obligations and have not accrued any liabilities related to such indemnification

obligations in our financial statements.

Recent Accounting Pronouncements

In April 2003, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 149, Amendment of

Statement 133 on Derivative Instruments and Hedging Activities, which amends and clarifies accounting for

derivative instruments, including certain derivative instruments embedded in other contracts, and for hedging

activities under SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities. SFAS No. 149 is

generally effective for derivative instruments, including derivative instruments embedded in certain contracts,

entered into or modified after June 30, 2003, and for hedging relationships designated after June 30, 2003. The

adoption of SFAS No. 149 did not have a material impact on our operating results or financial condition.

In May 2003, the FASB issued SFAS No. 150, Accounting for Certain Financial Instruments with

Characteristics of Both Liabilities and Equity, which provides guidance for the classification and measurement

of certain financial instruments with characteristics of both liabilities and equity. SFAS No. 150 is effective for

financial instruments entered into or modified after May 31, 2003, and otherwise is effective at the beginning of

the first interim period beginning after June 15, 2003. The adoption of SFAS No. 150 did not have a material

impact on our operating results or financial condition.

24