Mazda 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

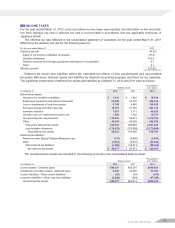

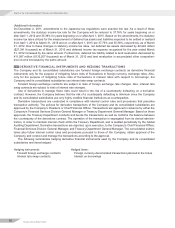

(Additional Information)

On December 2, 2011, amendments to the Japanese tax regulations were enacted into law. As a result of these

amendments, the statutory income tax rate for the Company will be reduced to 37.76% for years beginning on or

after April 1, 2012 and 35.38% for years beginning on or after April 1, 2015. Based on the amendments, the statutory

income tax rates utilized for the measurement of deferred tax assets and liabilities expected to be settled or realized

from April 1, 2012 to March 31, 2015 and on or after April 1, 2015 are 37.76% and 35.38%, respectively, as of March

31, 2012. Due to these changes in statutory income tax rates, net deferred tax assets decreased by ¥2,242 million

($27,341 thousand) as of March 31, 2012 and deferred income tax expense recognized for the year ended March

31, 2012 increased by the same amount. Furthermore, deferred tax liability related to land revaluation decreased by

¥11,087 million ($135,207 thousand) as of March 31, 2012 and land revaluation in accumulated other comprehen-

sive income increased by the same amount.

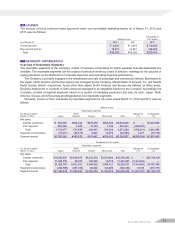

15 DERIVATIVE FINANCIAL INSTRUMENTS AND HEDGING TRANSACTIONS

The Company and its consolidated subsidiaries use forward foreign exchange contracts as derivative financial

instruments only for the purpose of mitigating future risks of fluctuations in foreign currency exchange rates. Also,

only for the purpose of mitigating future risks of fluctuations in interest rates with respect to borrowings, the

Company and its consolidated subsidiaries use interest rate swap contracts.

Forward foreign exchange contracts are subject to risks of foreign exchange rate changes. Also, interest rate

swap contracts are subject to risks of interest rate changes.

Use of derivatives to manage these risks could result in the risk of a counterparty defaulting on a derivative

contract. However, the Company believes that the risk of a counterparty defaulting is minimum since the Company

and its consolidated subsidiaries use only highly credible financial institutions as counterparties.

Derivative transactions are conducted in compliance with internal control rules and procedures that prescribe

transaction authority. The policies for derivative transactions of the Company and its consolidated subsidiaries are

approved by the Company’s President or Chief Financial Officer. Transactions are approved in advance by either the

Company’s Financial Services Division General Manager or Treasury Department General Manager. Based on these

approvals, the Treasury Department conducts and books the transactions as well as confirms the balance between

the counterparty of the derivatives contract. The operation of the transaction is segregated from its clerical adminis-

tration, in order to maintain internal check within the Treasury Department, and is audited periodically by the Global

Auditing Department. Derivative transactions are reported, upon execution, to the Company’s Chief Financial Officer,

Financial Services Division General Manager, and Treasury Department General Manager. The consolidated subsid-

iaries also follow internal control rules and procedures pursuant to those of the Company, obtain approval of the

Company, and conduct and manage the transactions according to the approval.

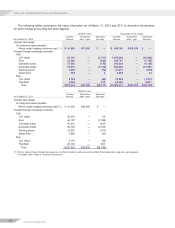

The following summarizes hedging derivative financial instruments used by the Company and its consolidated

subsidiaries and items hedged:

Hedging instruments: Hedged items:

Forward foreign exchange contracts Foreign currency-denominated transactions planned in the future

Interest rate swap contracts Interest on borrowings

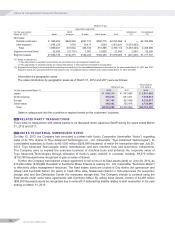

Notes to Consolidated Financial Statements

Mazda Annual Report 2012

50