Mazda 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

nated loan from our main financial institutions. This led to a significant dilution of Mazda’s

shares and imposed a burden on existing shareholders, but we intend to quickly meet the

expectations of shareholders and raise shareholder value through the swift and steady

implementation of the measures contained in the Structural Reform Plan.

Mazda’s policy is to determine the amount of dividend payments each fiscal year, taking into

account financial results and the operating environment. With the recording of a net loss and

a retained loss, we have decided to forgo the payment of a year-end dividend for the fiscal

year March 2012. In addition, we are expecting to record a retained loss again in the fiscal

year March 2013, and therefore payment of dividends is to be suspended for the fiscal year

March 2013. Going forward, we aim to restore the dividend by the fiscal year March 2016

through the swift and steady implementation of the Structural Reform Plan. We regret the

necessity of this decision and ask for shareholders’ understanding.

Going forward, I intend to consolidate the Group’s strength so that we can work as “One

Mazda” to achieve a resilient management structure that will not be significantly impacted

by exchange rate movements, and to raise shareholder value. Beginning with refining our

base technologies, Mazda is taking a unique approach toward creating next-generation auto-

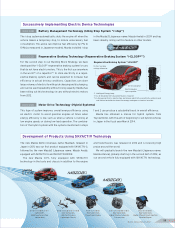

mobiles, as demonstrated to date in our proprietary Building Block Strategy. The devel-

opment and introduction of i-stop was the first step in this process. The i-ELOOP regenerative

braking technology being introduced in the fiscal year March 2013 is the second step, and as

a third step, we intend to introduce engine drive technologies in the near future.

From 2012, we have begun the full-scale introduction of next-generation products fully

equipped with SKYACTIV technology, and the market will begin to experience the value and

quality of these products. The first product, the new CX-5, is off to a spectacular start and has

exceeded our expectations. We will continue to deliver competitive products and quality that

promises safety and peace of mind, focusing on the customers who support us around the

world, as we develop a strong brand as a “Mazda that earns the absolute satisfaction and

trust of customers.” I would like to thank our shareholders and investors, and all other stake-

holders, for your continued support and cooperation.

Representative Director, Chairman of the Board, President and CEO

Returns to

Shareholders

In Conclusion

Building a “Mazda that earns

the absolute satisfaction and

trust of customers” through

highly competitive products

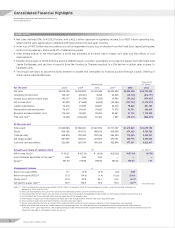

Public Offering and Subordinated Loan

Overview

Amount procured

Capital increase via public

offering: ¥144.2 billion

Subordinated loan: ¥70.0 billion

Issue price ¥124/share

Amount paid ¥118.88/share

No. of shares issued 1,219 million shares

No. of shares issued

after capital increase 2,999 million shares

Financial indicators after capital increase

As of the end of

December 2011

As of March 31,

2012

Equity ratio 19% 24% 26%*

Net debt-to-equity

ratio 155% 64% 53%*

Book value per share ¥183 ¥157

* After the recognition of equity capital attributes of the

subordinated loan

Mazda Annual Report 2012 9