Mazda 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

* Ratios after the recognition of equity capital attributes

of the subordinated loan.

* Ratios after the recognition of equity capital attributes

of the subordinated loan.

20092008

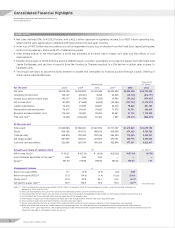

Net Sales

Billions of yen

2010 2011 2012 2013

(Outlook)

2,535.9

3,475.8

2,163.9 2,325.7

2,033.1 2,200.0

Operating Income/

Operating Income Margin

Billions of yen/%

(28.4)

162.1

9.5 23.8 30.0

(38.7)

(1.1)

4.7

0.4 1.0 1.4

(1.9)

20092008 2010 2011 2012 2013

(Outlook)

Net Income

Billions of yen

(71.5)

91.8

(6.5)

(60.0)

(107.7)

10.0

20092008 2010 2011 2012 2013

(Outlook)

ROE/ROA

%

2008 2009 2010 2011 2012

17.9

4.7

(3.8)

(0.3)

(3.2) (5.8)

(14.8)

(1.4)

(12.8)

(24.0)

2008

Free Cash Flow

Billions of yen

2009 2010 2011 2012

10.2

(129.2)

(79.4)

67.4

1.6

2008

Capital Expenditures/

Depreciation and Amortization

Billions of yen

2009 2010 2011 2012

75.5 74.2

81.8 84.0

29.8

76.4

44.7

71.6 68.8

78.0

Equity/Equity Ratio

Billions of yen/%

2008 2009 2010 2011 2012

554.2

414.7

509.8

430.5

474.4

27.8

22.9

26.1

24.2

26.3*

281.1

532.6

300.8

375.8 370.2

50.9

128.9

74.0

86.3

52.7*

Net Financial Debt/

Net Debt-to-equity Ratio

Billions of yen/%

2008 2009 2010 2011 2012

114.4

96.0

85.2 91.0 91.7

3.3 3.8 3.9 3.9 4.5

Research and Development Costs/

Share of Net Sales

Billions of yen/%

2008 2009 2010 2011 2012

Operating income

Operating income margin

Equity

Equity ratio

Net financial debt

Net debt-to-equity ratio

Research and development costs

Share of net sales

Capital expenditures

Depreciation and amortization

ROE

ROA

(Years ended March 31)

(Years ended March 31)

(Years ended March 31)(Years ended March 31)

(Years ended March 31)

(As of March 31)

(Years ended March 31)

(Years ended March 31)

(As of March 31)

Mazda Annual Report 2012 3