Mazda 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

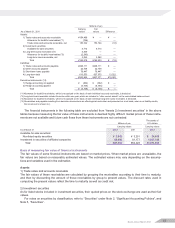

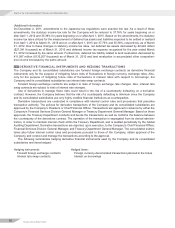

12 EQUITY

Under Japanese laws and regulations, the entire amount paid for new shares is required to be designated as

common stock. However, a company may, by a resolution of the Board of Directors, designate an amount not

exceeding one half of the price of the new shares as additional paid-in capital, which is included in capital surplus.

Under the Corporate Law (“the Law”), in cases where dividend distribution of surplus is made, the smaller of

an amount equal to 10% of the dividend or the excess, if any, of 25% of common stock over the total of additional

paid-in capital and legal earnings reserve, must be set aside as additional paid-in capital or legal earnings reserve.

Legal earnings reserve is included in retained earnings in the accompanying consolidated balance sheets. Legal

earnings reserve and additional paid-in capital could be used to eliminate or reduce a deficit or could be capitalized

by a resolution of the shareholders’ meeting.

Additional paid-in capital and legal earnings reserve may not be distributed as dividends. Under the Law, all addi-

tional paid-in capital and legal earnings reserve may be transferred to other capital surplus and retained earnings,

respectively, which are potentially available for dividends.

The maximum amount that the Company can distribute as dividends is calculated based on the non-consolidated

financial statements of the Company in accordance with the Law. Cash dividends charged to retained earnings

during the fiscal year were year-end cash dividends for the preceding fiscal year and interim cash dividends for the

current fiscal year.

The appropriations are not accrued in the consolidated financial statements for the corresponding period, but are

recorded in the subsequent accounting period after shareholders’ approval has been obtained. For the year ended

March 31, 2012, no year-end dividends were appropriated.

In conjunction with a public stock offering with the stock payment date of March 12, 2012 and a new share alloca-

tion to third parties with the stock payment date of March 27, 2012, the total number of shares outstanding increased

by 1,219,000,000 shares, and common stock and capital surplus increased by ¥72,457 million ($883,622 thousand).

Also, by approval of the shareholders’ meeting held on June 27, 2012, the number of shares authorized to be

issued have increased by 3,000,000,000 shares to 6,000,000,000 shares.

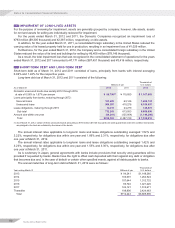

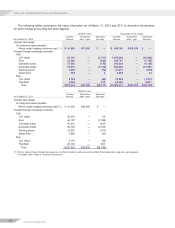

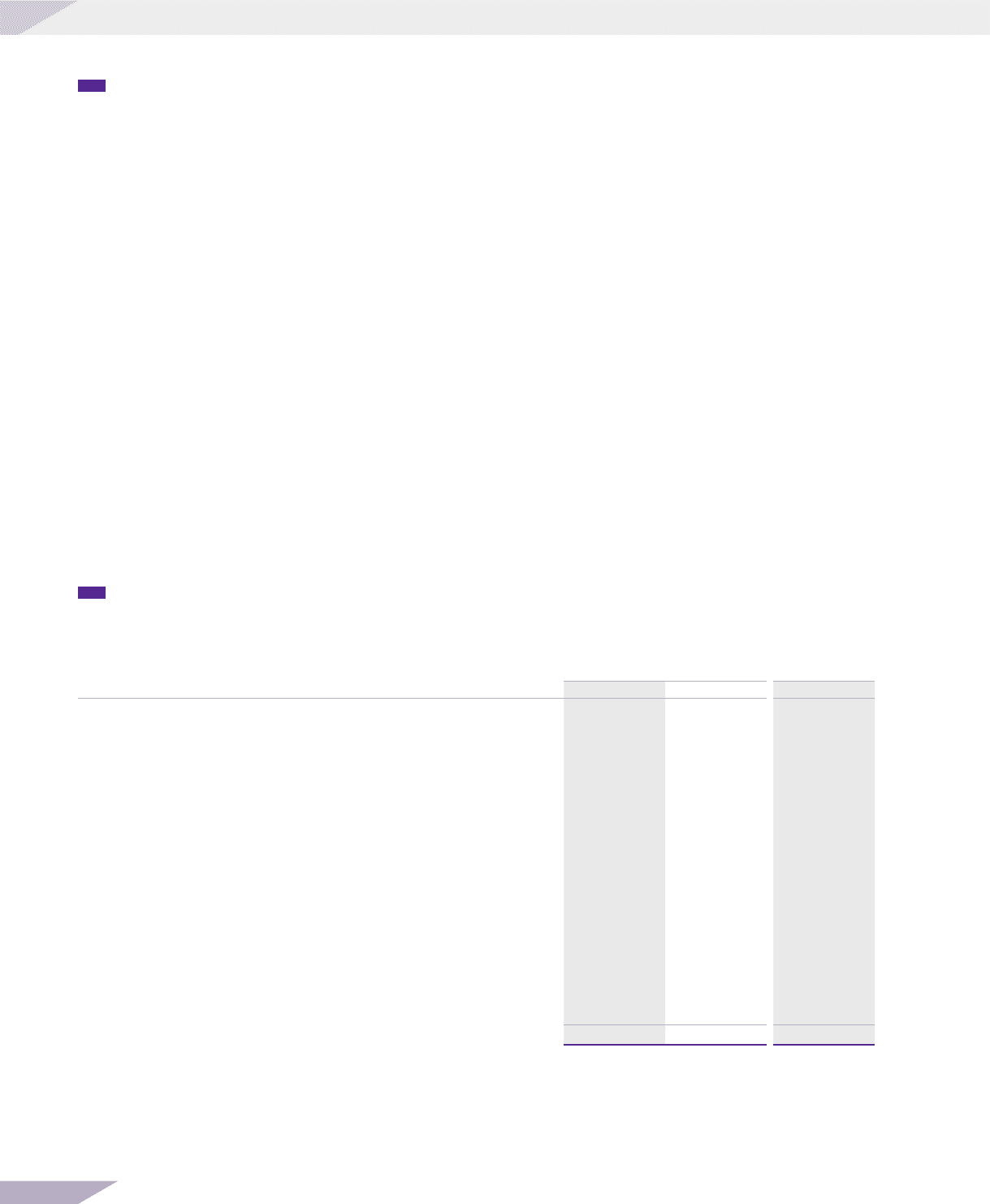

13 OTHER INCOME/(EXPENSES)

The components of “Other, net” in Other income/(expenses) in the consolidated statements of operations for the

years ended March 31, 2012 and 2011 were comprised as follows:

Millions of yen

Thousands of

U.S. dollars

For the years ended March 31 2012 2011 2012

Gain on sale of investment securities, net ¥ — ¥ 15 $ —

Gain on sale of investment in affiliates, net — 702 —

Reversal of investment valuation allowance 495 285 6,037

Loss on retirement and sale of property, plant and equipment, net (3,270) (1,908) (39,878)

Rental income 1,885 2,023 22,988

Loss on sale of receivables (983) (1,234) (11,988)

Loss on impairment of long-lived assets (7,171) (3,416) (87,451)

Foreign exchange gain 2,929 9,230 35,720

Compensation received for the exercise of eminent domain 257 2 3,134

Gain on reversal of subscription rights to shares 201 8 2,451

Reserve for loss from business of affiliates — (8,533) —

Reserve for environment measures (19) (11) (232)

Adoption of accounting standards for asset retirement obligations — (2,684) —

Loss on disaster(*1) (3,731) (5,211) (45,500)

Loss on abolishment of retirement benefit plan(*2) (1,044) — (12,732)

Business restructuring costs(*3) (4,079) — (49,744)

Other (2,643) (1,469) (32,232)

Total ¥(17,173) ¥(12,201) $(209,427)

(*1) The effect of the Great East Japan Earthquake.

(*2) Refer to “Employees’ severance and retirement benefits” under Note 2, “Significant Accounting Policies”.

(*3) Retirement benefits in some foreign consolidated subsidiaries and compensation payments to some dealers to implement structural reforms.

Notes to Consolidated Financial Statements

Mazda Annual Report 2012

48