Mazda 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

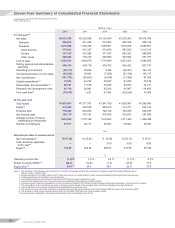

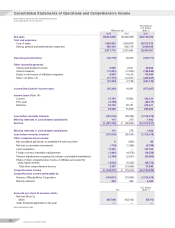

(Net Income)

Net other expenses were ¥16.5 billion. This included loss on

impairment of fixed assets, loss on disaster from the Great East

Japan Earthquake, and business restructuring costs. Conse-

quently, loss before income taxes was ¥55.3 billion, repre-

senting a year-on-year decline of ¥71.3 billion in net results.

A write-off of deferred tax assets was implemented, and net

loss was ¥107.7 billion, compared with ¥60.0 billion in the previous

year. The net loss per share of common stock was ¥57.80,

compared with the previous year’s ¥33.92 net loss per share.

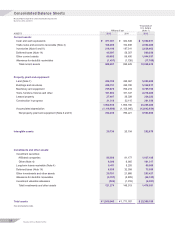

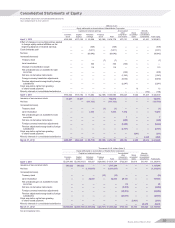

Financial Position

Total assets as of March 31, 2012, stood at ¥1,915.9 billion. This

represented a ¥144.2 billion increase from the end of the

previous fiscal year, reflecting increases in cash and time

deposits as well as certificates of deposit due to the capital

increase. Cash and cash equivalents increased ¥154.5 billion,

to ¥477.3 billion. Inventories were up ¥19.2 billion, to ¥216.2

billion, while net property, plant and equipment decreased

¥2.0 billion, to ¥784.2 billion.

Total short- and long-term interest-bearing debt increased

¥85.1 billion, to ¥778.1 billion. This total included the syndicated

loan of ¥70.0 billion. Net interest-bearing debt—interest-

bearing debt minus the ¥477.3 billion of cash and cash equiva-

lents—decreased ¥69.4 billion, to ¥300.8 billion, and the net

debt-to-equity ratio stood at 64.2%. (52.7% after recognition

of the equity credit attributes of the subordinated loan). Total

liabilities at the fiscal year-end stood at ¥1,441.5 billion, which

was ¥100.3 billion more than at the end of the previous fiscal

year, due principally to an increase in interest-bearing debt.

Equity increased ¥43.9 billion, to ¥474.4 billion as of the

fiscal year-end. Although the net loss reduced retained

earnings, the increase in equity was attributable to gains in

common stock and capital surplus due to the issuance of new

shares. Equity used for the calculation of the equity ratio—

equity less minority interests and stock acquisition rights—

increased ¥40.0 billion, to ¥468.9 billion, for a 0.3 percentage

point increase in the equity ratio, to 24.5% (26.3% after recog-

nition of the equity credit attributes of the subordinated loan).

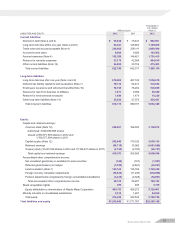

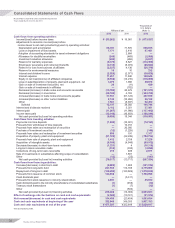

Cash Flows

(Cash Flow from Operating Activities)

Net cash used in operating activities was ¥9.1 billion. Loss

before income taxes was ¥55.3 billion, while working capital

declined, due primarily to an increase in inventories.

(Cash Flow from Investing Activities)

Net cash used in investing activities was ¥70.3 billion. This

mainly reflected ¥61.7 billion in capital expenditures.

(Cash Flow from Financing Activities)

Net cash provided by financing activities amounted to ¥236.5

billion. This primarily reflected the issuance of new shares and

an increase in long-term loans.

Free cash flow—the sum of operating cash flow and investing

cash flow—was negative in the amount of ¥79.4 billion.

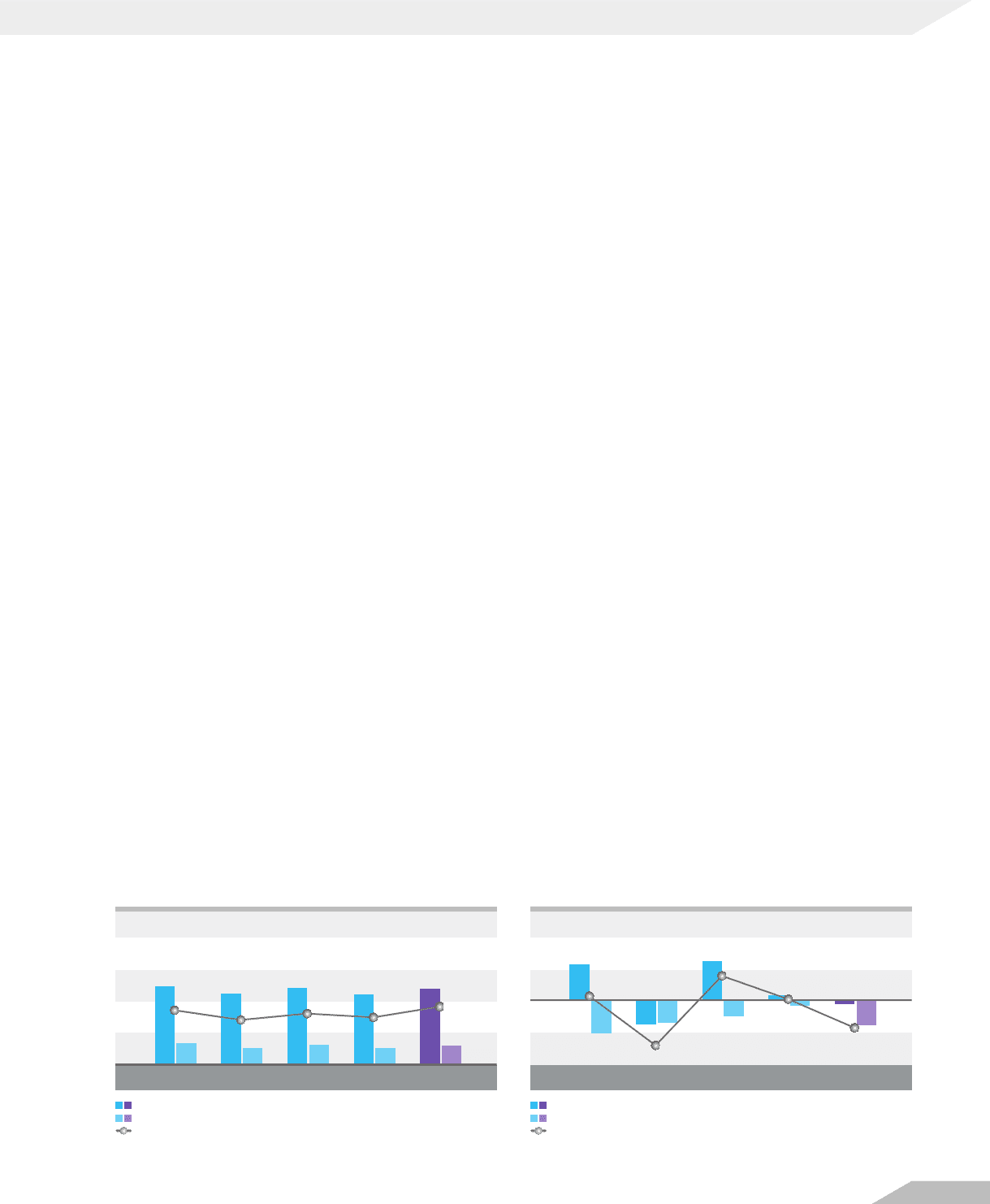

2008

Total Assets/Equity/Equity Ratio

Billions of yen

2009 2010 2011 2012

1,985.6 1,801.0 1,947.8 1,771.8 1,915.9

554.2 414.7 509.8 430.5 474.4

27.8 22.9 26.1 24.2 26.3*

2008

Cash Flows

Billions of yen

2009 2010 2011 2012

103.0

(67.4)(61.8)

(44.3)

(92.8) (70.3)

111.6

15.3

(9.1)

(13.7)

10.2

67.4

(129.2)

(79.4)

1.6

Total assets

Equity

Equity ratio

* Ratios after the recognition of equity capital attributes of the subordinated loan.

Cash flow from operating activities

Cash flow from investing activities

Free cash flow

(As of March 31) (Years ended March 31)

Mazda Annual Report 2012 31