Mazda 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

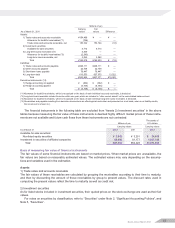

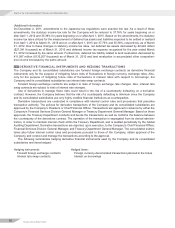

The assets pledged as collateral for short-term debt of ¥37,103 million ($452,476 thousand) and ¥35,809 million,

and long-term debt of ¥104,245 million ($1,271,280 thousand) and ¥63,996 million at March 31, 2012 and 2011,

respectively, were as follows:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2012 2011 2012

Property, plant and equipment, at net book value ¥409,461 ¥411,384 $4,993,427

Inventories 37,264 — 454,439

Other 28,926 3 352,756

Total ¥475,651 ¥411,387 $5,800,622

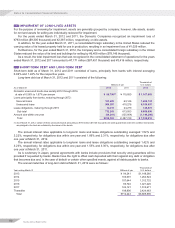

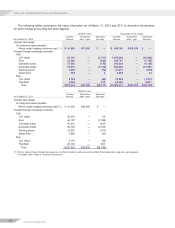

10 EMPLOYEES’ SEVERANCE AND RETIREMENT BENEFITS

The liabilities for severance and retirement benefits as of March 31, 2012 and 2011 consisted of the following:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2012 2011 2012

Projected benefit obligation ¥ 287,761 ¥ 277,155 $ 3,509,280

Unrecognized prior service costs 11,935 14,954 145,549

Unrecognized actuarial differences (43,324) (42,864) (528,341)

Less fair value of pension assets (182,870) (176,076) (2,230,122)

Prepaid pension cost 2,648 5,115 32,293

Liability for severance and retirement benefits ¥ 76,150 ¥ 78,284 $ 928,659

Severance and retirement benefit expenses for the years ended March 31, 2012 and 2011 consisted of the

following:

Millions of yen

Thousands of

U.S. dollars

For the years ended March 31 2012 2011 2012

Service costs—benefits earned during the year ¥10,475 ¥10,773 $127,744

Interest cost on projected benefit obligation 6,147 6,381 74,963

Expected return on plan assets (3,372) (3,379) (41,122)

Amortization of prior service costs (1,664) (2,244) (20,293)

Amortization of actuarial differences 8,057 8,287 98,256

Severance and retirement benefit expenses ¥19,643 ¥19,818 $239,548

For the years ended March 31, 2012 and 2011, the discount rates were primarily 1.8% and 2.1%, respectively.

For both the years ended March 31, 2012 and 2011, the rates of expected return on plan assets were primarily 1.5%.

For both the years ended March 31, 2012 and 2011, the estimated amount of all retirement benefits to be paid at

the future retirement dates is allocated equally to each service year using the estimated number of total service years.

For the years ended March 31, 2012 and 2011, accrued pension costs related to defined contribution plans were

charged to income as ¥2,315 million ($28,232 thousand) and ¥2,249 million, respectively.

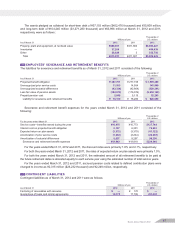

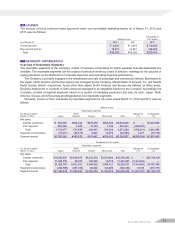

1 1 CONTINGENT LIABILITIES

Contingent liabilities as of March 31, 2012 and 2011 were as follows:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2012 2011 2012

Factoring of receivables with recourse ¥ — ¥ 170 $ —

Guarantees of loans and similar agreements 19,175 17,795 233,841

Mazda Annual Report 2012 47