Mazda 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Q SKYACTIV-equipped models have received high

praise globally. What will be the key points for

utilizing this reputation to increase sales volume?

A There are two main points. The first is to boost production

capacity. Our initial production plan for the new CX-5 was for

160,000 units annually, but current orders are running at close

to double that level, so unfortunately production capacity is

holding back sales. Bringing this situation back into an appro-

priate balance is an urgent issue. We will therefore increase

annual production capacity to the 200,000 unit level from this

summer and to the 240,000 unit level in March 2013.

The other point is to enhance the quality of sales. In general,

we have put in place a structure by which the launch of a

model fully equipped with SKYACTIV technology significantly

enhances the model’s competitiveness, leading to further

sales growth. We have also learned from talking with customers

at dealerships that many of the customers visiting our show-

rooms had not previously considered purchasing a Mazda

vehicle. These are mainly customers who have previously

purchased premium brand automobiles and customers who

show a strong interest in fuel efficiency. They hear positive

things about the new CX-5’s fuel economy and drive, for

example, and then decide to visit a showroom. We must further

raise the quality of our sales and service to fully capture these

opportunities, and are working with sales companies to accel-

erate these activities at showrooms.

In this way, we intend to further increase sales volumes by

simultaneously enhancing the “hardware” element of production

and the “software” element of sales and service.

Q What is your outlook for the respective operating

environments in developed countries and emerging

countries for the fiscal year March 2013?

A With regard to developed countries, Europe is the region of

most concern. Given the financial crisis there, we expect

economic stagnation to continue, especially in southern Europe.

However we believe the impact on Mazda’s earnings will be

negligible. In addition to economic stagnation, we recognize

that last year was an off year in terms of model replacements,

and the fact that we were not able to launch new products was

a large part of the reason for the decline in sales volume.

On the other hand, in North America, where we have intro-

duced SKYACTIV-equipped models, sales momentum has

picked up and sales volume grew. We recently launched the

new CX-5 in Europe as well, and orders in Germany, Austria,

and the Netherlands were more than double the amount we

anticipated. This shows that, as in North America, there is a

very good opportunity for a turnaround to an offensive

position. The economy remains sluggish, however, but for an

automaker of Mazda’s size, I believe that we will be able to turn

around the situation by introducing attractive products.

Demand has been recovering in the North American market,

where sales are driven by the new Mazda3 (Japanese name:

Mazda Axela) fully equipped with SKYACTIV technology, and

we see solid sales continuing going forward.

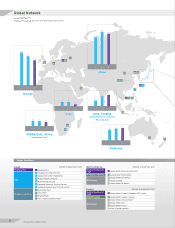

In terms of emerging countries, we see strong demand

continuing in the ASEAN region, which is a priority region for

Mazda. Growth in China’s demand is slowing as well, but we

expect the market to continue to grow. We launched the new

Mazda3 in China in 2011, so this will make a full-year contri-

bution in the fiscal year March 2013. Going forward, we plan to

make a comeback with the launch of a new CX-5.

Q What do you consider to be the key point for

achieving ¥30 billion in operating income?

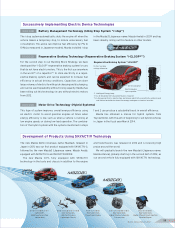

A New product launches will be key. The new CX-5 is the first car

to incorporate throughout the entire vehicle, the Monotsukuri

Innovation that we have been implementing for several years,

and we have achieved a high degree of cost competitiveness

through the common use of platforms and parts through inte-

grated planning. By adding the appeal of the KODO design

concept, we were able to curtail incentives and improve the

profit per vehicle by roughly ¥150,000 compared with the CX-7

in the next-higher segment. This improvement is expected to

make a significant contribution toward achieving ¥30 billion in

operating income.

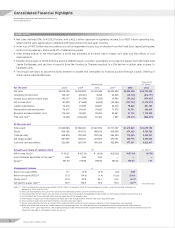

(38.7)

+42.7 +3.2

(5.5) (3.8)

30.0

+32.1

Volume &

Mix

Feign

ex

C t improvements Marketing

expenses

Others

Operating Income Change For The Year Ended March 31, 2012

Billions of yen

Operating income for the

year ended March 31, 2012

Operating income for the

year ended March 31, 2011 YoY +68.7

WorsenImprove

Mazda Annual Report 2012 11