Mazda 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

North America

Europe

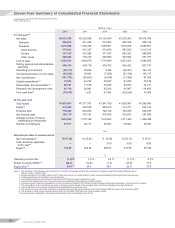

2009

Sales Volume

Thousands of units/%

2010 2011 2012

107

240

97

210

104

238

104

268

105

285

2.0 1.9 2.0 2.0

2013 (Outlook)

Sales volume in U.S.

Sales volume in Canada and others

Market share in U.S.

2009

Sales Volume

Thousands of units/%

2010 2011 2012

322

1.7

1.3 1.2

1.0

239 212 183 185

2013 (Outlook)

Sales volume

Market share

Total demand grew 9%, to 13.20 million units in the United States, and rose 3%, to 1.61

million units, in Canada. Mazda’s North American sales volume increased 9%, to

372,000 units. We recorded large growth in the United States, with a 12% increase to

268,000 units, on a full-year contribution from the Mazda2 and the launches of the

new, SKYACTIV-equipped Mazda3 and CX-5 in the second half. Our market share was

roughly flat from the previous year at 2.0%. In Canada, our sales volume declined

4%, to 72,000 units, and our market share decreased 0.4 percentage point, to 4.4%,

as a result of intensive competition through incentives. Since entering the market,

our sales volume and market share in Mexico have shown steady increases, and for

the year, our sales volume rose 14%, to 30,000 units, and our market share grew 0.2

percentage point, to 3.3%.

Orders for the new CX-5, released in North America in February 2012, have been

trending ahead of plan. Strong customer interest is also demonstrated by the fact

that showroom traffic and Internet searches are surpassing our expectations.

For the fiscal year March 2013, we are planning for a 6% increase in sales volume

in the United States, to 285,000 units, with market share remaining flat at 2.0%, on

full-year contributions from the new, SKYACTIV-equipped Mazda3 and CX-5. Our plan

for Canada is for a 7% increase in sales volume, to 77,000 units, driven by the new,

SKYACTIV-equipped Mazda3 and CX-5.

We intend to utilize the product strength of SKYACTIV-equipped cars to sell without

discounting, while at the same time improving residual value. Our policy going

forward of further enhancing brand value by curtailing incentives and reducing fleet

sales is unchanged.

Despite lower demand in southern Europe, strong economies in areas including

Russia and Germany led to a 1% increase in total European demand, to 18.50 million

units. Mazda’s sales volume declined 14%, to 183,000 units, and our market share

contracted 0.2 percentage point, to 1.0%, as supplies were restricted by the Great

East Japan Earthquake. There was also an impact from the fact that our models sold

in Europe have been on the market for some time, which combined with the yen’s

appreciation weakened our competitiveness. In Germany, however, sales in February

and March 2012 were higher year-on-year as a result of stepped up sales promotions

since the beginning of 2012 and the launch of the new CX-5. The new CX-5, which we

launched in Europe during the fourth quarter, is off to a solid start, with roughly

7,000 units sold in major countries like Russia and Germany within the fiscal year.

We see sales volume bottoming out in the fiscal year March 2013, primarily from the

new CX-5, Europe’s first SKYACTIV-equipped model, and new model launches going

forward, and our plan is for a 1% increase, to 185,000 units. We began our campaign

for the new CX-5 with test drives for local staff and journalists one year prior to the

launch, as a way of deepening their understanding of SKYACTIV technology. This

enabled us to fully present the appeal of SKYACTIV technology to customers, and

orders are outpacing our plan by a wide margin. We intend to commence full-scale

sales in southern Europe going forward, with the aim of further increasing sales.

(Years ended March 31)

(Years ended March 31)

Mazda Annual Report 2012 21