Macy's 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-36

11. Stock Based Compensation

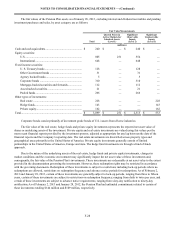

During 2009, the Company obtained shareholder approval for the Macy’s 2009 Omnibus Incentive Compensation Plan

under which up to 51 million shares of Common Stock may be issued. This plan is intended to help the Company attract and

retain directors, officers, other key executives and employees and is also intended to provide incentives and rewards relating to

the Company’s business plans to encourage such persons to devote themselves to the business of the Company. Prior to 2009,

the Company had two equity plans; the Macy's 1995 Executive Equity Incentive Plan and the Macy's 1994 Stock Incentive

Plan. After shareholders approved the 2009 Omnibus Incentive Compensation Plan, Common Stock may no longer be granted

under the Macy's 1995 Executive Equity Incentive Plan or the Macy's 1994 Stock Incentive Plan. The following disclosures

present the Company’s equity plans on a combined basis. The equity plan is administered by the Compensation and

Management Development Committee of the Board of Directors (the “CMD Committee”). The CMD Committee is authorized

to grant options, stock appreciation rights, restricted stock and restricted stock units to officers and key employees of the

Company and its subsidiaries and to non-employee directors. There have been no grants of stock appreciation rights under the

equity plans.

Stock option grants have an exercise price at least equal to the market value of the underlying common stock on the date

of grant, have ten-year terms and typically vest ratably over four years of continued employment. Restricted stock and time-

based restricted stock unit awards generally vest one to four years from the date of grant. Performance-based restricted stock

units generally are earned based on the attainment of specified goals achieved over the performance period.

As of February 2, 2013, 32.1 million shares of common stock were available for additional grants pursuant to the

Company’s equity plan. Shares awarded are generally issued from the Company's treasury stock.

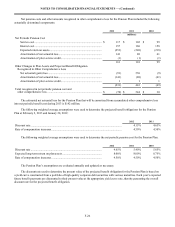

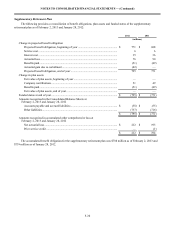

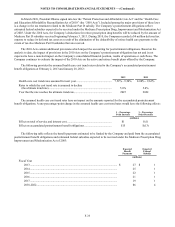

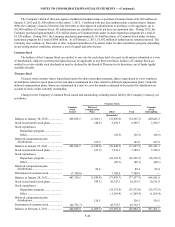

Stock-based compensation expense included the following components:

2012 2011 2010

(millions)

Stock options........................................................................................ $ 28 $ 28 $ 34

Stock credits......................................................................................... 6 20 19

Restricted stock.................................................................................... 1 2 2

Restricted stock units........................................................................... 26 20 11

$ 61 $ 70 $ 66

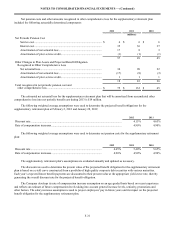

All stock-based compensation expense is recorded in SG&A expense in the Consolidated Statements of Income. The

income tax benefit recognized in the Consolidated Statements of Income related to stock-based compensation was $22 million,

$25 million, and $24 million, for 2012, 2011 and 2010, respectively.

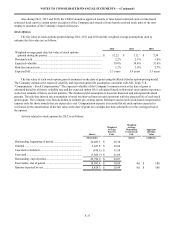

As of February 2, 2013, the Company had $48 million of unrecognized compensation costs related to nonvested stock

options, which is expected to be recognized over a weighted average period of approximately 1.8 years, $1 million of

unrecognized compensation costs related to nonvested restricted stock, which is expected to be recognized over a weighted

average period of approximately 1 year, and $27 million of unrecognized compensation costs related to nonvested restricted

stock units, which is expected to be recognized over a weighted average period of approximately 1.4 years.

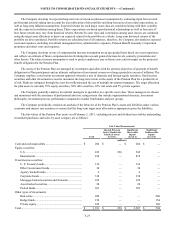

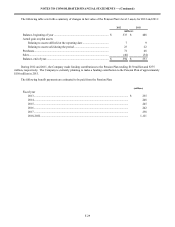

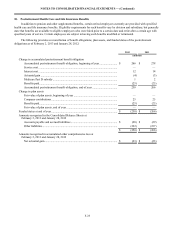

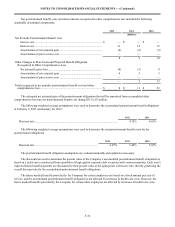

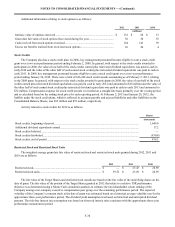

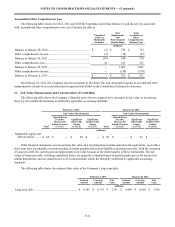

During 2012, 2011 and 2010, the CMD Committee approved awards of performance-based restricted stock units to

certain senior executives of the Company. Each award reflects a target number of shares (“Target Shares”) that may be issued to

the award recipient. These awards may be earned upon the completion of three-year performance periods ending January 31,

2015, February 1, 2014 and February 2, 2013, respectively. Whether units are earned at the end of the performance period will

be determined based on the achievement of certain performance objectives set by the CMD Committee in connection with the

issuance of the units. The performance objectives are based on the Company’s business plan covering the performance period.

The performance objectives include achieving a cumulative EBITDA level for the performance period and also include an

EBITDA as a percent to sales ratio and a return on invested capital ratio. The performance-based restricted stock units awarded

during 2012 also include a performance objective relating to relative total shareholder return (“TSR”). Relative TSR reflects

the change in the value of the Company’s common stock over the performance period in relation to the change in the value of

the common stock of a ten-company executive compensation peer group over the performance period, assuming the

reinvestment of dividends. Depending on the results achieved during the three-year performance periods, the actual number of

shares that a grant recipient receives at the end of the period may range from 0% to 150% of the Target Shares granted.