Macy's 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

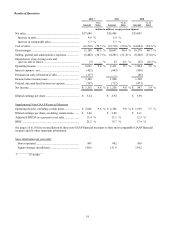

Net Interest Expense

Net interest expense for 2011 decreased $65 million compared to 2010. Net interest expense for 2011 benefited from

lower levels of borrowings as compared to 2010, resulting from both the early retirement of outstanding debt during fiscal 2010

and the repayment of debt at maturity.

Premium on Early Retirement of Debt

Premium on early retirement of debt in 2010 included $66 million of expenses associated with the repurchase of $1,000

million indebtedness prior to maturity.

Effective Tax Rate

The Company's effective tax rate of 36.2% for 2011 and 35.8% for 2010 differ from the federal income tax statutory rate

of 35%, and on a comparative basis, principally because of the effect of state and local income taxes, including the settlement

of various tax issues and tax examinations.

Guidance

Based on its assessment of current and anticipated market conditions and its recent performance, the Company's 2013

assumptions include:

• Comparable sales increase in 2013 of approximately 3.5% from 2012 levels;

• Diluted earnings per share of $3.90 to $3.95;

• Funding contribution to the Pension Plan of $150 million; and

• Capital expenditures of approximately $925 million.

The Company's budgeted capital expenditures are primarily related to store remodels, maintenance, the renovation of

Macy's Herald Square, technology and omnichannel investments, and distribution network improvements. The Company has

announced that in 2013 it intends to open new Macy's stores in Victorville, CA, Gurnee, IL, and Las Vegas, NV, a Macy's

replacement store in Bay Shore, NY, a new Bloomingdale's store in Glendale, CA, and a Bloomingdale's Outlet store in

Rosemont, IL. In addition, 2014 will include new Macy's stores in the Bronx, NY, Sarasota, FL, Las Vegas, NV, and a

Bloomingdale's replacement store in Palo Alto, CA. Management presently anticipates funding such expenditures with cash on

hand and cash from operations.