Macy's 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-35

In March 2010, President Obama signed into law the “Patient Protection and Affordable Care Act” and the “Health Care

and Education Affordability Reconciliation Act of 2010” (the “2010 Acts”). Included among the major provisions of these laws

is a change in the tax treatment related to the Medicare Part D subsidy. The Company’s postretirement obligations reflect

estimated federal subsidies expected to be received under the Medicare Prescription Drug, Improvement and Modernization Act

of 2003. Under the 2010 Acts, the Company’s deductions for retiree prescription drug benefits will be reduced by the amount of

Medicare Part D subsidies received beginning February 3, 2013. During 2010, the Company recorded a $4 million deferred tax

expense to reduce its deferred tax asset as a result of the elimination of the deductibility of retiree health care payments to the

extent of tax-free Medicare Part D subsidies that are received.

The 2010 Acts contain additional provisions which impact the accounting for postretirement obligations. Based on the

analysis to date, the impact of provisions in the 2010 Acts on the Company’s postretirement obligations has not and is not

expected to have a material impact on the Company’s consolidated financial position, results of operations or cash flows. The

Company continues to evaluate the impact of the 2010 Acts on the active and retiree benefit plans offered by the Company.

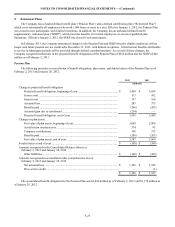

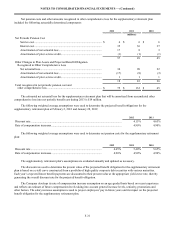

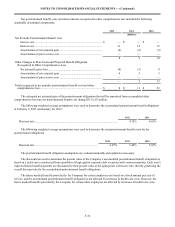

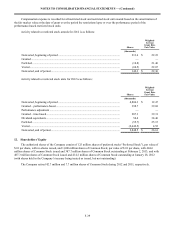

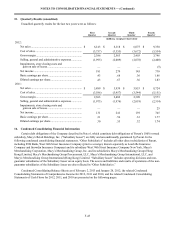

The following provides the assumed health care cost trend rates related to the Company’s accumulated postretirement

benefit obligations at February 2, 2013 and January 28, 2012:

2012 2011

Health care cost trend rates assumed for next year ................................................. 7.52% - 9.50% 8.08% - 9.62%

Rates to which the cost trend rate is assumed to decline

(the ultimate trend rate)........................................................................................ 5.0% 5.0%

Year that the rate reaches the ultimate trend rate..................................................... 2025 2022

The assumed health care cost trend rates have an impact on the amounts reported for the accumulated postretirement

benefit obligations. A one-percentage-point change in the assumed health care cost trend rates would have the following effects:

1 – Percentage

Point Increase 1 – Percentage

Point Decrease

(millions)

Effect on total of service and interest cost............................................................... $1 $(1)

Effect on accumulated postretirement benefit obligations...................................... $15 $(13)

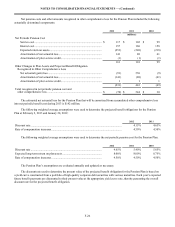

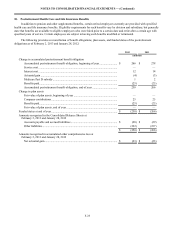

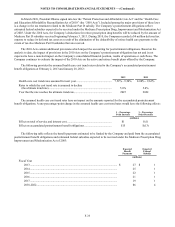

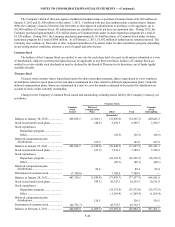

The following table reflects the benefit payments estimated to be funded by the Company and paid from the accumulated

postretirement benefit obligations and estimated federal subsidies expected to be received under the Medicare Prescription Drug

Improvement and Modernization Act of 2003:

Expected

Benefit

Payments

Expected

Federal

Subsidy

(millions)

Fiscal Year

2013.......................................................................................................................... $ 27 $ 1

2014.......................................................................................................................... 25 1

2015.......................................................................................................................... 22 1

2016.......................................................................................................................... 21 1

2017.......................................................................................................................... 19 1

2018-2022................................................................................................................. 86 4