Macy's 2012 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2012 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

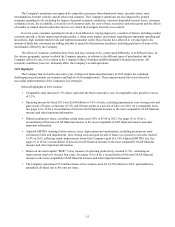

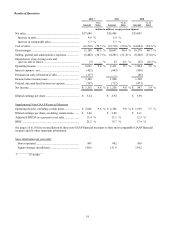

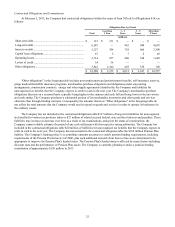

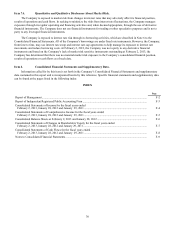

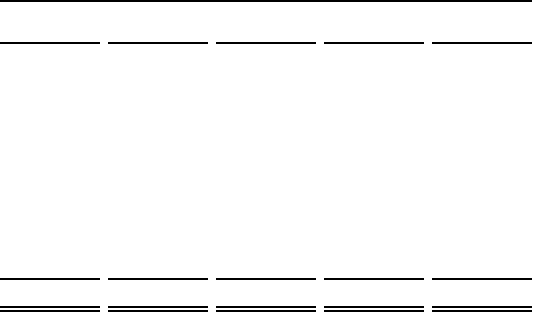

Contractual Obligations and Commitments

At February 2, 2013, the Company had contractual obligations (within the scope of Item 303(a)(5) of Regulation S-K) as

follows:

Obligations Due, by Period

Total Less than

1 Year 1 – 3

Years 3 – 5

Years More than

5 Years

(millions)

Short-term debt ...................................................................... $ 121 $ 121 $ — $ — $ —

Long-term debt....................................................................... 6,583 — 942 948 4,693

Interest on debt....................................................................... 5,127 394 729 606 3,398

Capital lease obligations ........................................................ 67 5 7 6 49

Operating leases..................................................................... 2,714 257 460 348 1,649

Letters of credit...................................................................... 3434———

Other obligations.................................................................... 3,942 2,342 493 339 768

$ 18,588 $ 3,153 $ 2,631 $ 2,247 $ 10,557

“Other obligations” in the foregoing table includes post employment and postretirement benefits, self-insurance reserves,

group medical/dental/life insurance programs, merchandise purchase obligations and obligations under outsourcing

arrangements, construction contracts, energy and other supply agreements identified by the Company and liabilities for

unrecognized tax benefits that the Company expects to settle in cash in the next year. The Company's merchandise purchase

obligations fluctuate on a seasonal basis, typically being higher in the summer and early fall and being lower in the late winter

and early spring. The Company purchases a substantial portion of its merchandise inventories and other goods and services

otherwise than through binding contracts. Consequently, the amounts shown as “Other obligations” in the foregoing table do

not reflect the total amounts that the Company would need to spend on goods and services in order to operate its businesses in

the ordinary course.

The Company has not included in the contractual obligations table $127 million of long-term liabilities for unrecognized

tax benefits for various tax positions taken or $27 million of related accrued federal, state and local interest and penalties. These

liabilities may increase or decrease over time as a result of tax examinations, and given the status of examinations, the

Company cannot reliably estimate the period of any cash settlement with the respective taxing authorities. The Company has

included in the contractual obligations table $20 million of liabilities for unrecognized tax benefits that the Company expects to

settle in cash in the next year. The Company has not included in the contractual obligation table the $168 million Pension Plan

liability. The Company's funding policy is to contribute amounts necessary to satisfy pension funding requirements, including

requirements of the Pension Protection Act of 2006, plus such additional amounts from time to time as are determined to be

appropriate to improve the Pension Plan's funded status. The Pension Plan's funded status is affected by many factors including

discount rates and the performance of Pension Plan assets. The Company is currently planning to make a pension funding

contribution of approximately $150 million in 2013.