Macy's 2012 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2012 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

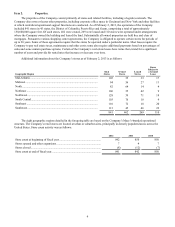

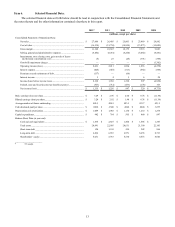

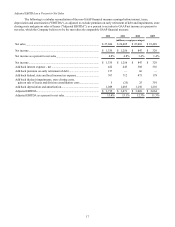

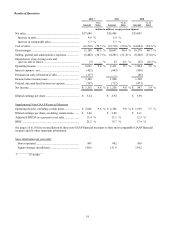

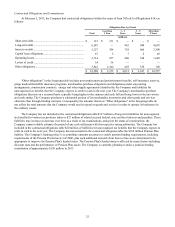

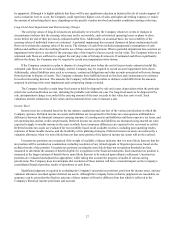

Adjusted EBITDA as a Percent to Net Sales

The following is a tabular reconciliation of the non-GAAP financial measure earnings before interest, taxes,

depreciation and amortization ("EBITDA"), as adjusted to exclude premium on early retirement of debt and impairments, store

closing costs and gain on sales of leases ("Adjusted EBITDA"), as a percent to net sales to GAAP net income as a percent to

net sales, which the Company believes to be the most directly comparable GAAP financial measure.

2012 2011 2010 2009

(millions, except percentages)

Net sales...................................................................................................... $ 27,686 $ 26,405 $ 25,003 $ 23,489

Net income.................................................................................................. $ 1,335 $ 1,256 $ 847 $ 329

Net income as a percent to net sales............................................................ 4.8% 4.8% 3.4% 1.4%

Net income.................................................................................................. $ 1,335 $ 1,256 $ 847 $ 329

Add back interest expense - net .................................................................. 422 443 508 556

Add back premium on early retirement of debt .......................................... 137 — 66 —

Add back federal, state and local income tax expense................................ 767 712 473 178

Add back (deduct) impairments, store closing costs,

gain on sale of leases and division consolidation costs........................... 5(25) 25 391

Add back depreciation and amortization..................................................... 1,049 1,085 1,150 1,210

Adjusted EBITDA....................................................................................... $ 3,715 $ 3,471 $ 3,069 $ 2,664

Adjusted EBITDA as a percent to net sales................................................ 13.4% 13.1% 12.3% 11.3%