Macy's 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

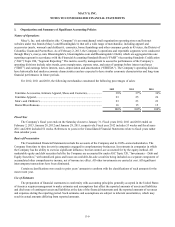

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-12

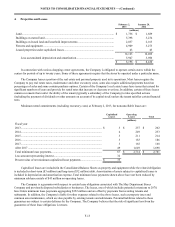

The Company classifies certain long-lived assets as held for disposal by sale and ceases depreciation when the particular

criteria for such classification are met, including the probable sale within one year. For long-lived assets to be disposed of by

sale, an impairment charge is recorded if the carrying amount of the asset exceeds its fair value less costs to sell. Such

valuations include estimations of fair values and incremental direct costs to transact a sale.

Leases

The Company recognizes operating lease minimum rentals on a straight-line basis over the lease term. Executory costs

such as real estate taxes and maintenance, and contingent rentals such as those based on a percentage of sales are recognized as

incurred.

The lease term, which includes all renewal periods that are considered to be reasonably assured, begins on the date the

Company has access to the leased property. The Company receives contributions from landlords to fund buildings and leasehold

improvements. Such contributions are recorded as deferred rent and amortized as reductions to lease expense over the lease

term.

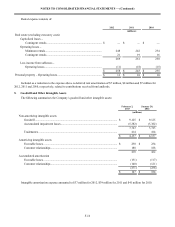

Goodwill and Other Intangible Assets

The carrying value of goodwill and other intangible assets with indefinite lives are reviewed at least annually for possible

impairment in accordance with ASC Subtopic 350-20 “Goodwill.” Goodwill and other intangible assets with indefinite lives

have been assigned to reporting units for purposes of impairment testing. The reporting units are the Company’s retail operating

divisions. Goodwill and other intangible assets with indefinite lives are tested for impairment annually at the end of the fiscal

month of May. The Company evaluates qualitative factors to determine if it is more likely than not that the fair value of a

reporting unit is less than its carrying value and whether it is necessary to perform the two-step goodwill impairment process.

If required, the first step involves a comparison of each reporting unit’s fair value to its carrying value and the Company

estimates fair value based on discounted cash flows. The reporting unit’s discounted cash flows require significant

management judgment with respect to sales, gross margin and SG&A rates, capital expenditures and the selection and use of an

appropriate discount rate. The projected sales, gross margin and SG&A expense rate assumptions and capital expenditures are

based on the Company’s annual business plan or other forecasted results. Discount rates reflect market-based estimates of the

risks associated with the projected cash flows directly resulting from the use of those assets in operations. The estimates of fair

value of reporting units are based on the best information available as of the date of the assessment. If the carrying value of a

reporting unit exceeds its estimated fair value in the first step, a second step is performed, in which the reporting unit’s goodwill

is written down to its implied fair value. The second step requires the Company to allocate the fair value of the reporting unit

derived in the first step to the fair value of the reporting unit’s net assets, with any fair value in excess of amounts allocated to

such net assets representing the implied fair value of goodwill for that reporting unit. If the carrying value of an individual

indefinite-lived intangible asset exceeds its fair value, such individual indefinite-lived intangible asset is written down by an

amount equal to such excess.

Capitalized Software

The Company capitalizes purchased and internally developed software and amortizes such costs to expense on a straight-

line basis over two to five years. Capitalized software is included in other assets on the Consolidated Balance Sheets.

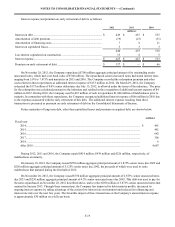

Gift Cards

The Company only offers non-expiring gift cards to its customers. At the time gift cards are sold, no revenue is

recognized; rather, the Company records an accrued liability to customers. The liability is relieved and revenue is recognized

equal to the amount redeemed at the time gift cards are redeemed for merchandise. The Company records income from

unredeemed gift cards (breakage) as a reduction of SG&A expenses, and income is recorded in proportion and over the time

period gift cards are actually redeemed. At least three years of historical data, updated annually, is used to determine actual

redemption patterns.

Self-Insurance Reserves

The Company, through its insurance subsidiary, is self-insured for workers compensation and general liability claims up

to certain maximum liability amounts. Although the amounts accrued are actuarially determined based on analysis of historical

trends of losses, settlements, litigation costs and other factors, the amounts the Company will ultimately disburse could differ

from such accrued amounts.