Macy's 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-24

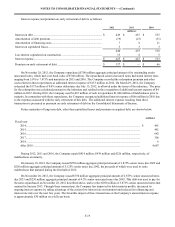

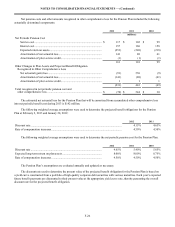

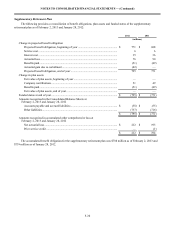

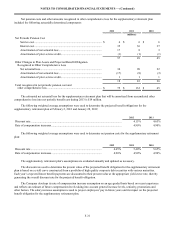

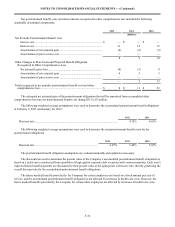

The Company classifies unrecognized tax benefits not expected to be settled within one year as other liabilities on the

Consolidated Balance Sheets.

The Company classifies federal, state and local interest and penalties not expected to be settled within one year as other

liabilities on the Consolidated Balance Sheets and follows a policy of recognizing all interest and penalties related to

unrecognized tax benefits in income tax expense. Federal, state and local interest and penalties, which amounted to a credit of

$10 million for 2012, a credit of $2 million for 2011, and a charge of $5 million for 2010, are reflected in income tax expense.

The Company had $55 million and $69 million accrued for the payment of federal, state and local interest and penalties at

February 2, 2013 and January 28, 2012, respectively. The accrued federal, state and local interest and penalties primarily relates

to state tax issues and the amount of penalties paid in prior periods, and the amount of penalties accrued at February 2, 2013

and January 28, 2012 are insignificant. At February 2, 2013, $27 million of federal, state and local interest and penalties is

included in other liabilities and $28 million is included in current income taxes on the Consolidated Balance Sheets.

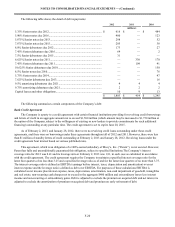

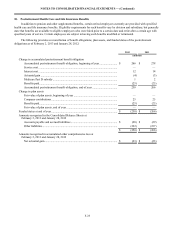

The Company or one of its subsidiaries files income tax returns in the U.S. federal jurisdiction and various state and local

jurisdictions. The Company is no longer subject to U.S. federal income tax examinations by tax authorities for years before

2009. With respect to state and local jurisdictions, with limited exceptions, the Company and its subsidiaries are no longer

subject to income tax audits for years before 2003. Although the outcome of tax audits is always uncertain, the Company

believes that adequate amounts of tax, interest and penalties have been accrued for any adjustments that are expected to result

from the years still subject to examination.