Macy's 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-29

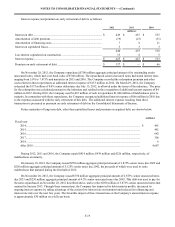

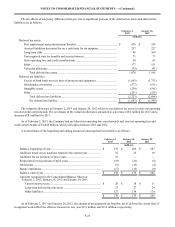

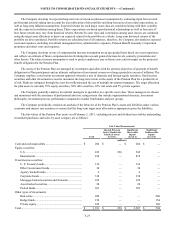

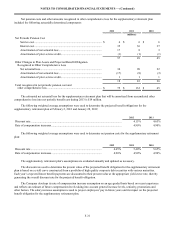

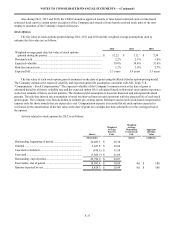

The following table sets forth a summary of changes in fair value of the Pension Plan’s level 3 assets for 2012 and 2011:

2012 2011

(millions)

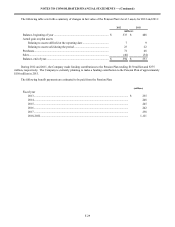

Balance, beginning of year ............................................................................ $ 533 $ 488

Actual gain on plan assets:

Relating to assets still held at the reporting date .................................... 7 9

Relating to assets sold during the period................................................ 23 22

Purchases........................................................................................................ 71 48

Sales............................................................................................................... (40)(34)

Balance, end of year....................................................................................... $ 594 $ 533

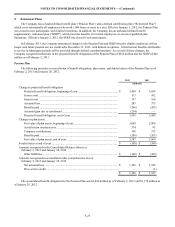

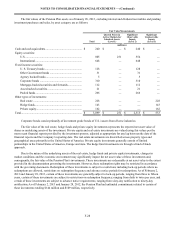

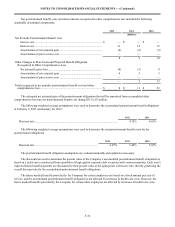

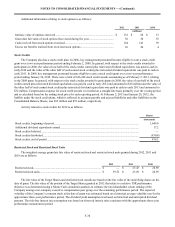

During 2012 and 2011, the Company made funding contributions to the Pension Plan totaling $150 million and $375

million, respectively. The Company is currently planning to make a funding contribution to the Pension Plan of approximately

$150 million in 2013.

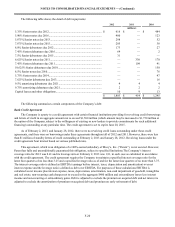

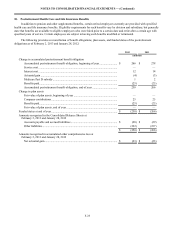

The following benefit payments are estimated to be paid from the Pension Plan:

(millions)

Fiscal year

2013.................................................................................................................................... $ 255

2014.................................................................................................................................... 248

2015.................................................................................................................................... 245

2016.................................................................................................................................... 242

2017.................................................................................................................................... 238

2018-2022........................................................................................................................... 1,121