Macy's 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-11

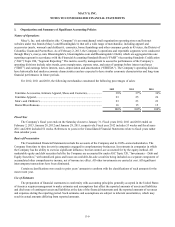

Vendor Allowances

The Company receives certain allowances as reimbursement for markdowns taken and/or to support the gross margins

earned in connection with the sales of merchandise. These allowances are generally credited to cost of sales at the time the

merchandise is sold in accordance with ASC Subtopic 605-50, “Customer Payments and Incentives.” The Company also

receives advertising allowances from approximately 1,000 of its merchandise vendors pursuant to cooperative advertising

programs, with some vendors participating in multiple programs. These allowances represent reimbursements by vendors of

costs incurred by the Company to promote the vendors’ merchandise and are netted against advertising and promotional costs

when the related costs are incurred in accordance with ASC Subtopic 605-50. Advertising allowances in excess of costs

incurred are recorded as a reduction of merchandise costs and, ultimately, through cost of sales when the merchandise is sold.

The arrangements pursuant to which the Company’s vendors provide allowances, while binding, are generally informal in

nature and one year or less in duration. The terms and conditions of these arrangements vary significantly from vendor to

vendor and are influenced by, among other things, the type of merchandise to be supported.

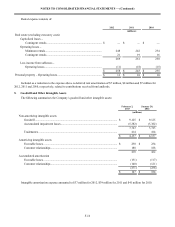

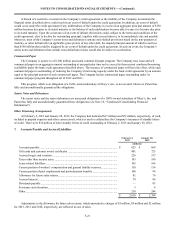

Advertising

Department store non-direct response advertising and promotional costs are expensed either as incurred or the first time

the advertising occurs. Direct response advertising and promotional costs are deferred and expensed over the period during

which the sales are expected to occur, generally one to four months. Advertising and promotional costs and cooperative

advertising allowances were as follows:

2012 2011 2010

(millions)

Gross advertising and promotional costs ........................................................ $ 1,603 $ 1,507 $ 1,417

Cooperative advertising allowances................................................................ 422 371 345

Advertising and promotional costs, net of

cooperative advertising allowances............................................................. $ 1,181 $ 1,136 $ 1,072

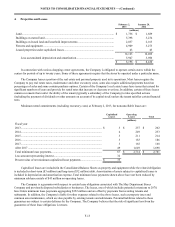

Property and Equipment

Depreciation of owned properties is provided primarily on a straight-line basis over the estimated asset lives, which range

from fifteen to fifty years for buildings and building equipment and three to fifteen years for fixtures and equipment. Real estate

taxes and interest on construction in progress and land under development are capitalized. Amounts capitalized are amortized

over the estimated lives of the related depreciable assets. The Company receives contributions from developers and

merchandise vendors to fund building improvement and the construction of vendor shops. Such contributions are netted against

the capital expenditures.

Buildings on leased land and leasehold improvements are amortized over the shorter of their economic lives or the lease

term, beginning on the date the asset is put into use.

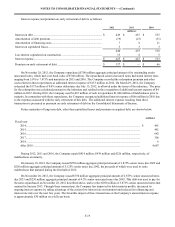

The carrying value of long-lived assets is periodically reviewed by the Company whenever events or changes in

circumstances indicate that a potential impairment has occurred. For long-lived assets held for use, a potential impairment has

occurred if projected future undiscounted cash flows are less than the carrying value of the assets. The estimate of cash flows

includes management’s assumptions of cash inflows and outflows directly resulting from the use of those assets in operations.

When a potential impairment has occurred, an impairment write-down is recorded if the carrying value of the long-lived asset

exceeds its fair value. The Company believes its estimated cash flows are sufficient to support the carrying value of its long-

lived assets. If estimated cash flows significantly differ in the future, the Company may be required to record asset impairment

write-downs.

If the Company commits to a plan to dispose of a long-lived asset before the end of its previously estimated useful life,

estimated cash flows are revised accordingly, and the Company may be required to record an asset impairment write-down.

Additionally, related liabilities arise such as severance, contractual obligations and other accruals associated with store closings

from decisions to dispose of assets. The Company estimates these liabilities based on the facts and circumstances in existence

for each restructuring decision. The amounts the Company will ultimately realize or disburse could differ from the amounts

assumed in arriving at the asset impairment and restructuring charge recorded.