Lumber Liquidators 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

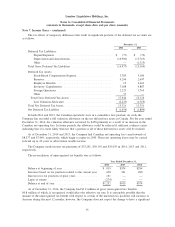

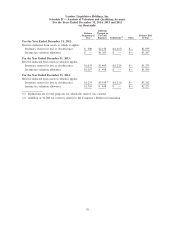

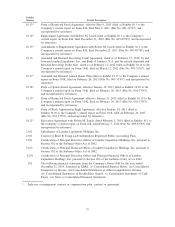

Lumber Liquidators Holdings, Inc.

Schedule II — Analysis of Valuation and Qualifying Accounts

For the Years Ended December 31, 2014, 2013 and 2012

(in thousands)

Balance

Beginning of

Year

Additions

Charged to

Cost and

Expenses Deductions

(1)

Other

Balance End

of Year

For the Year Ended December 31, 2012:

Reserve deducted from assets to which it applies

Inventory reserve for loss or obsolescence..... $ 500 $2,150 $(1,615) $— $1,035

Income tax valuation allowance ........... $ — $1,267 $ — $— $1,267

For the Year Ended December 31, 2013:

Reserve deducted from assets to which it applies

Inventory reserve for loss or obsolescence .... $1,035 $1,465 $(1,225) $— $1,275

Income tax valuation allowance ........... $1,267 $ 498 $ — $— $1,765

For the Year Ended December 31, 2014:

Reserve deducted from assets to which it applies

Inventory reserve for loss or obsolescence .... $1,275 $3,198

(2)

$(1,231) $— $3,242

Income tax valuation allowance ........... $1,765 $ 458 $ — $— $2,223

(1) Deductions are for the purposes for which the reserve was created.

(2) Addition of $1,200 for reserves related to the Company’s Bellawood transition.

70