Lumber Liquidators 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

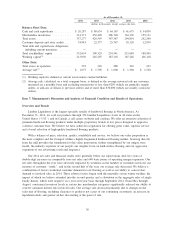

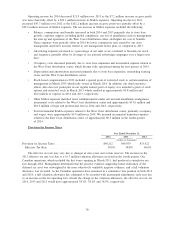

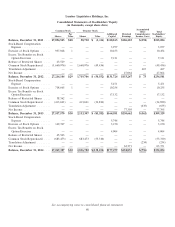

Merchandise inventories and available inventory per store in operation on December 31 were as follows:

2014 2013 2012

(in thousands)

Inventory − Available for Sale ................. $265,949 $212,617 $168,409

Inventory − Inbound In-Transit ................. 48,422 39,811 38,295

Total Merchandise Inventories ................ $314,371 $252,428 $206,704

Available Inventory Per Store ................ $ 756 $ 669 $ 585

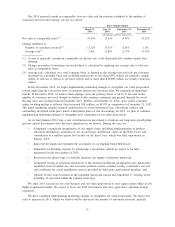

Available inventory per store at December 31, 2014 was higher than both December 31, 2013 and

December 31, 2012 due to weaker than expected net sales, increases in merchandise categories previously

constrained and increases in moldings and accessories. In addition, inventory levels were higher as we

prepared for transition and consolidation of our East Coast distribution operations in the first quarter of 2015,

and in anticipation of Chinese New Year which was later in February than most years. Further, inventory

within our Californian distribution facility was elevated to provide a measure of safety stock while a new

labor contract was negotiated for west coast ports. We expect 2015 inventory levels to decrease in comparison

to 2014 by the end of June and normalize in the range of $640,000 to $690,000 per store throughout the

second half of 2015.

Inbound in-transit inventory generally varies due to the timing of certain international shipments and

certain seasonal factors, including international holidays, rainy seasons and specific merchandise category

planning.

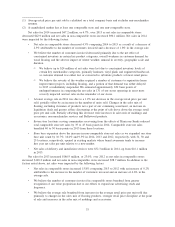

Cash Flows

Operating Activities. Net cash provided by operating activities was $57.1 million for 2014,

$53.0 million for 2013, and $47.3 million for 2012. The $4.1 million increase in net cash comparing 2014 to

2013 is primarily due to an increase in customer deposits and store credits and a reduction in merchandise

inventories, net of the change in accounts payable. These increases were offset by less profitable operations.

The $5.7 million increase in net cash comparing 2013 to 2012 is primarily due to more profitable operations

which were partially offset by a larger and earlier build in merchandise inventories net of the change in

accounts payable.

Investing Activities. Net cash used in investing activities was $71.1 million for 2014, $28.6 million

for 2013, and $13.4 million for 2012. Net cash used in investing activities in each year included capital

purchases for store base expansion, and investments in and maintenance of forklifts, our integrated

information technology solution, our finishing lines and our Corporate Headquarters. In 2014 and 2013, capital

expenditures also included remodeling of existing stores to our expanded showroom format and $37.6 million

and $8.4 million, respectively, for land, buildings and equipment for the East Coast distribution facility and

$1.2 million and $2.1 million, respectively, for equipment and leasehold improvements for the West Coast

distribution facility.

Financing Activities. Net cash used by financing activities was $46.2 million in 2014, $7.4 million in

2013 and $31.9 million in 2012. We used cash of $53.3 million, $34.8 million and $49.4 million in 2014,

2013 and 2012, respectively, to repurchase our common stock, primarily under our stock repurchase program

initiated in February 2012. Stock option exercises provided $7.2 million, $27.3 million and $17.5 million in

2014, 2013 and 2012, respectively. During 2014, we borrowed $53.0 million under our revolving credit

facility to fund capital expenditures and inventory purchases, however, this amount was fully repaid by

year-end.

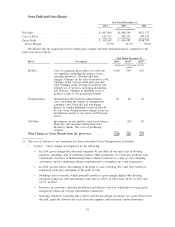

Revolving Credit Agreement

A revolving credit agreement (the ‘‘Revolver’’) providing for borrowings up to $50.0 million is available

to us through expiration on February 21, 2017. During 2014, we borrowed and repaid a total of $53.0 million

against the Revolver, and during 2013 and 2012, we did not borrow against the Revolver. The Revolver

supported $2.7 million and $2.3 million of letters of credit at December 31, 2014 and 2013, respectively. At

December 31, 2012, there were no outstanding commitments under letters of credit. The Revolver is primarily

available to fund inventory purchases, including the support of up to $10.0 million for letters of credit, and for

38