Lumber Liquidators 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

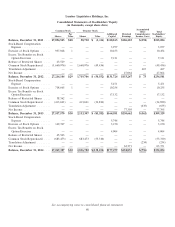

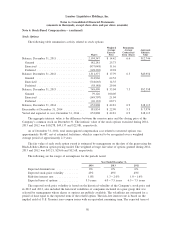

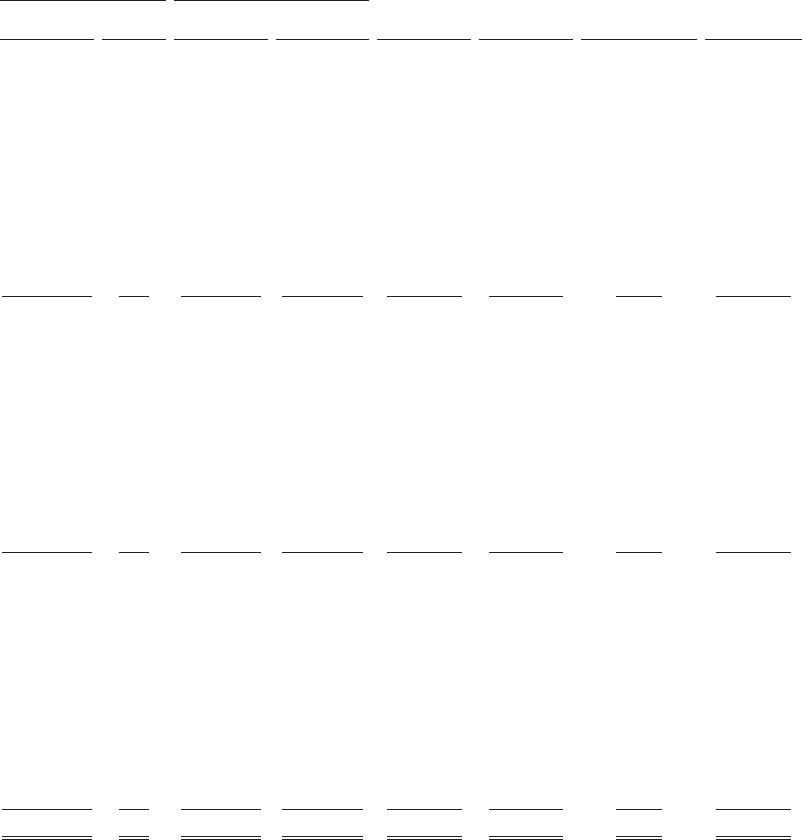

Lumber Liquidators Holdings, Inc.

Consolidated Statements of Stockholders’ Equity

(in thousands, except share data)

Common Stock Treasury Stock

Additional

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss)

Total

Stockholders’

EquityShares

Par

Value Shares Value

Balance, December 31, 2011 .... 27,894,543 $28 58,730 $ (1,116) $110,163 $106,203 $(194) $215,084

Stock-Based Compensation

Expense ................. — — — — 3,977 — — 3,977

Exercise of Stock Options ...... 937,048 1 — — 10,453 — — 10,454

Excess Tax Benefits on Stock

Option Exercises ........... — — — — 7,131 — — 7,131

Release of Restricted Shares .... 43,529 — — — — — — —

Common Stock Repurchased .... (1,660,976) — 1,660,976 (49,436) — — — (49,436)

Translation Adjustment ........ — — — — — — 267 267

Net Income ................ — — — — — 47,064 — 47,064

Balance, December 31, 2012 .... 27,214,144 $29 1,719,706 $ (50,552) $131,724 $153,267 $ 73 $234,541

Stock-Based Compensation

Expense ................. — — — — 5,471 — — 5,471

Exercise of Stock Options ...... 718,665 1 — — 10,254 — — 10,255

Excess Tax Benefits on Stock

Option Exercises ........... — — — — 17,132 — — 17,132

Release of Restricted Shares .... 38,362 — — — — — — —

Common Stock Repurchased .... (413,601) — 413,601 (34,830) — — — (34,830)

Translation Adjustment ........ — — — — — — (635) (635)

Net Income ................ — — — — — 77,395 — 77,395

Balance, December 31, 2013 .... 27,557,570 $30 2,133,307 $ (85,382) $164,581 $230,662 $(562) $309,329

Stock-Based Compensation

Expense ................. — — — — 5,744 — — 5,744

Exercise of Stock Options ...... 149,707 — — — 3,150 — — 3,150

Excess Tax Benefits on Stock

Option Exercises ........... — — — — 4,004 — — 4,004

Release of Restricted Shares .... 45,503 — — — — — — —

Common Stock Repurchased .... (683,473) — 683,473 (53,310) — — — (53,310)

Translation Adjustment ........ — — — — — — (234) (234)

Net Income ................ — — — — — 63,371 — 63,371

Balance, December 31, 2014 .... 27,069,307 $30 2,816,780 $(138,692) $177,479 $294,033 $(796) $332,054

See accompanying notes to consolidated financial statements

48