Lumber Liquidators 2014 Annual Report Download - page 49

Download and view the complete annual report

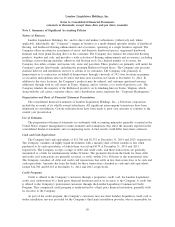

Please find page 49 of the 2014 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Interest Rate Risk.

We are exposed to interest rate risk through the investment of our cash and cash equivalents. We invest

our cash in short-term investments with maturities of three months or less. Changes in interest rates affect the

interest income we earn, and therefore impact our cash flows and results of operations. In addition,

borrowings under our revolving credit agreement are exposed to interest rate risk due to the variable rate of

the facility. As of December 31, 2014, no amounts were outstanding under the Revolver.

We currently do not engage in any interest rate hedging activity and currently have no intention to do so

in the foreseeable future. However, in the future, in an effort to mitigate losses associated with these risks, we

may at times enter into derivative financial instruments, although we have not historically done so. We do not,

and do not intend to, engage in the practice of trading derivative securities for profit.

Exchange Rate Risk.

Less than two percent of our revenue, expense and capital purchasing activities are transacted in

currencies other than the U.S. dollar, including the Euro, Canadian dollar, Chinese yuan and Brazilian real.

We currently do not engage in any exchange rate hedging activity and currently have no intention to do

so in the foreseeable future. However, in the future, in an effort to mitigate losses associated with these risks,

we may at times engage in transactions involving various derivative instruments to hedge revenues, inventory

purchases, assets and liabilities denominated in foreign currencies.

41