Lumber Liquidators 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•Transportation: Gross margin was impacted by changes in our supply chain structure, changes in

international and domestic transportation rates and certain operational efficiencies.

䡩Gross margin benefited in 2014 and 2013 from generally lower average international

transportation rates. In 2014, lower international rates were primarily driven by shipments to

our West Coast distribution center, which were significantly less than rates to the East Coast.

䡩Gross margin in 2014 was not materially impacted by domestic costs other than delivery, as the

increase in domestic miles traveled due to increasing inventory levels was offset by a net lower

average cost per domestic mile. In 2013, gross margin benefited from lower aggregate domestic

costs as the impact of the reduction in the average cost per mile traveled was greater than the

impact of increased domestic miles.

•All Other Costs: Gross margin was impacted in 2014 due to greater costs of merchandise

obsolescence and shrink, including increased inventory reserves, and our increased investment in

quality control and assurance, offset by lower sample and customer satisfaction costs.

䡩Higher total inventory levels carried throughout 2014 and the significant product transitions due

to the Bellawood transition and efforts to mitigate the adverse impact of constrained inventory

with substitute product resulted in higher 2014 shrink and an increase in the inventory reserve

for loss or obsolescence. Inventory obsolescence and shrink increased 24.3% in comparing 2014

to 2013, and the reserve at December 31, 2014 was $3.2 million, up from $1.3 million at the

end of 2013.

䡩In 2013 and 2012, gross margin benefitted from supply chain initiatives to improve the

accuracy and visibility of product movement within the distribution centers and the stores,

thereby lowering inventory shrink.

䡩Improvements to production efficiency lowered the cost per sample, more than offsetting an

increase in sample requests.

䡩Investments in quality control and customer support training, combined with improved control

over installation, resulted in lower aggregate customer satisfaction costs.

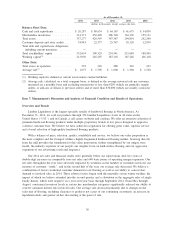

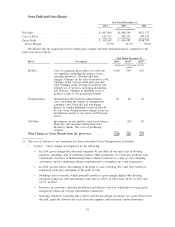

Operating Income and Operating Margin

Year Ended December 31,

2014 2013 2012

(dollars in thousands)

Gross Profit ................................... $418,167 $410,983 $308,785

SG&A Expenses ................................ 314,094 284,960 230,439

Operating Income ............................... $104,073 $126,023 $ 78,346

Operating Margin .............................. 9.9% 12.6% 9.6%

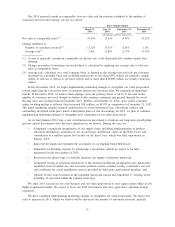

The following table sets forth components of our SG&A expenses for the periods indicated, as

a percentage of net sales. Individual line items include the impact of our finishing operations, with a credit for

these expenses included in other SG&A expenses.

Year Ended December 31,

2014 2013 2012

Total SG&A Expenses ........................... 30.0% 28.5% 28.3%

Salaries, Commissions and Benefits .................. 11.8% 12.1% 12.1%

Advertising .................................. 7.9% 7.6% 7.2%

Occupancy .................................. 4.2% 3.5% 3.7%

Depreciation and Amortization ..................... 1.4% 1.1% 1.2%

Stock-based Compensation ........................ 0.5% 0.6% 0.5%

Other SG&A Expenses .......................... 4.2% 3.6% 3.6%

35