Lumber Liquidators 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

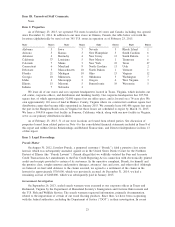

(1) Average retail price per unit sold is calculated on a total company basis and excludes non-merchandise

revenue.

(2) A cannibalized market has at least one comparable store and one non-comparable store.

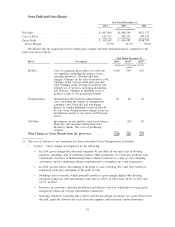

Net sales for 2014 increased $47.2 million, or 4.7%, over 2013 as net sales in comparable stores

decreased $42.9 million and net sales in non-comparable stores increased $90.1 million. Net sales in 2014

were impacted by the following factors:

• Net sales in comparable stores decreased 4.3% comparing 2014 to 2013 as a result of a decrease of

2.5% attributable to the number of customers invoiced and a decrease of 1.8% in the average sale.

• We believe the number of customers invoiced decreased primarily due to the net effect of

constrained inventory in certain key product categories, overall weakness in customer demand for

wood flooring and the adverse impact of winter weather, unusual in severity, geographic scale and

duration.

䡩We believe up to $24 million of net sales were lost due to constrained inventory levels of

certain key merchandise categories, primarily laminate, vinyl plank and engineered hardwood,

as customer demand was either lost or converted to substitute products at lower retail prices.

䡩We believe the severity of the weather required a number of customers to reprioritize home

improvement projects, including flooring, and a portion of that demand was either delayed

to 2015 or indefinitely suspended. We estimated approximately 650 basis points of

underperformance in comparing the net sales in 131 of our stores operating in areas most

severely impacted and net sales in the remainder of our stores.

• A lower average sale in 2014 was due to a 1.9% net decrease in the average retail price per unit

sold, partially offset by an increase in the number of units sold. Changes in the sales mix of

flooring, including clearance of products not a part of our continuing assortment, an increase in

liquidation deals and greater ad-hoc discounting at the point of sale drove down the average retail

price per unit sold. Partially offsetting this decrease were increases in sales mix of moldings and

accessories, non-merchandise services and Bellawood products.

• Seven store locations serving communities recovering from the effects of Hurricane Sandy reduced

total comparable store net sales by 35 to 45 basis points in 2014. Comparable store net sales

benefited 40 to 50 basis points in 2013 from these locations.

• Store base expansion drove the increase in non-comparable store net sales as we expanded our store

base unit count by 10.7%, 10.4% and 9.5% in 2014, 2013 and 2012, respectively, with 34, 30 and

25 locations, respectively, opened in existing markets where brand awareness tends to increase

first year net sales per unit relative to a new market.

• Net sales of delivery and installation services were $32.3 million in 2014, up from $16.1 million

in 2013.

Net sales for 2013 increased $186.9 million, or 23.0%, over 2012 as net sales in comparable stores

increased $128.2 million and net sales in non-comparable stores increased $58.7 million. In addition to the

factors noted above, net sales were impacted by the following factors:

• Net sales in comparable stores increased 15.8% comparing 2013 to 2012 with an increase of 9.2%

attributable to the increase in the number of customers invoiced and an increase of 6.6% in the

average sale.

• We believe the number of customers invoiced in comparable stores benefited from greater

recognition of our value proposition due to our efforts to expand our advertising reach and

frequency.

• We believe the average sale benefited from increases in the average retail price per unit sold due

primarily to changes in the sales mix of flooring products, stronger retail price discipline at the point

of sale and increases in the sales mix of moldings and accessories.

33