Lumber Liquidators 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

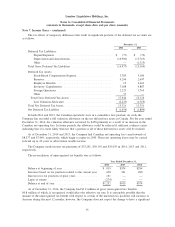

Note 7. Income Taxes − (continued)

effect on its results of operations, financial position or cash flows. As of December 31, 2013, the Company

had $0.9 million of gross unrecognized tax benefits, $0.6 million of which, if recognized, would affect the

effective tax rate. As of December 31, 2012, the Company had $0.6 million of gross unrecognized tax

benefits, $0.4 million of which, if recognized, would affect the effective tax rate.

The Company files income tax returns with the U.S. federal government and various state and foreign

jurisdictions. In the normal course of business, the Company is subject to examination by taxing authorities.

The Internal Revenue Service has completed audits of the Company’s federal income tax returns for years

through 2009.

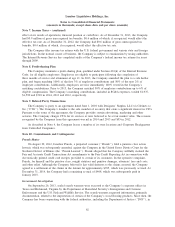

Note 8. Profit-sharing Plan

The Company maintains a profit-sharing plan, qualified under Section 401(k) of the Internal Revenue

Code, for all eligible employees. Employees are eligible to participate following the completion of

three months of service and attainment of age 21. In 2013, the Company amended the plan to a safe harbor

plan, and began matching 100% of the first 3% of employee contributions and 50% of the next 2% of

employee contributions. Additionally, employees are now immediately 100% vested in the Company’s

matching contributions. Prior to 2013, the Company matched 50% of employee contributions up to 6% of

eligible compensation. The Company’s matching contributions, included in SG&A expenses, totaled $1,937,

$1,590 and $749 in 2014, 2013 and 2012, respectively.

Note 9. Related Party Transactions

The Company is party to an agreement dated June 1, 2010 with Designers’ Surplus, LLC t/a Cabinets to

Go (‘‘CTG’’). The Company’s founder is the sole member of an entity that owns a significant interest in CTG.

Pursuant to the terms of the agreement, the Company provides certain advertising, marketing and other

services. The Company charges CTG for its services at rates believed to be at fair market value. The revenue

recognized by the Company from this agreement was nil in 2014 and 2013 and $55 in 2012.

As described in Note 4, the Company leases a number of its store locations and Corporate Headquarters

from Controlled Companies.

Note 10. Commitments and Contingencies

Prusak Matter

On August 30, 2012, Jaroslaw Prusak, a purported customer (‘‘Prusak’’), filed a putative class action

lawsuit, which was subsequently amended, against the Company in the United States District Court for the

Northern District of Illinois (the ‘‘Prusak Lawsuit’’). Prusak alleged that the Company willfully violated the

Fair and Accurate Credit Transactions Act amendments to the Fair Credit Reporting Act in connection with

electronically printed credit card receipts provided to certain of its customers. In the operative complaint,

Prusak, for himself and the putative class, sought statutory and punitive damages, attorneys’ fees and costs,

and other relief. Although the Company believed it has valid defenses to the claims asserted, the Company

agreed to a settlement of the claims in the lawsuit for approximately $705, which was previously accrued. At

December 31, 2014, the Company had a remaining accrual of $468, which was subsequently paid in

January 2015.

Government Investigation

On September 26, 2013, sealed search warrants were executed at the Company’s corporate offices in

Toano and Richmond, Virginia by the Department of Homeland Security’s Immigration and Customs

Enforcement and the U.S. Fish and Wildlife Service. The search warrants requested information, primarily

documentation, related to the importation of certain of the Company’s wood flooring products. Since then, the

Company has been cooperating with the federal authorities, including the Department of Justice (‘‘DOJ’’), in

62