Lumber Liquidators 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Lumber Liquidators Holdings, Inc.

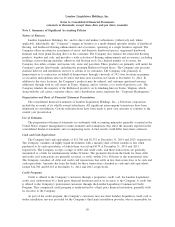

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

Note 1. Summary of Significant Accounting Policies − (continued)

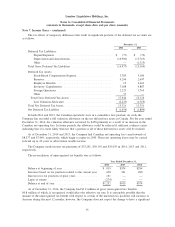

Income Taxes

Income taxes are accounted for in accordance with FASB ASC 740 (‘‘ASC 740’’). Income taxes are

provided for under the asset and liability method and consider differences between the tax and financial

accounting bases. The tax effects of these differences are reflected on the consolidated balance sheets as

deferred income taxes and measured using the effective tax rate expected to be in effect when the differences

reverse. ASC 740 also requires that deferred tax assets be reduced by a valuation allowance if it is more likely

than not that some portion of the deferred tax asset will not be realized. In evaluating the need for a valuation

allowance, the Company takes into account various factors, including the nature, frequency and severity of

current and cumulative losses, expected level of future taxable income, the duration of statutory carryforward

periods and tax planning alternatives. In future periods, any valuation allowance will be re-evaluated in

accordance with ASC 740, and a change, if required, will be recorded through income tax expense in the

period such determination is made.

The Company recognizes the tax benefit from an uncertain tax position only if it is more likely than not

that the tax position will be sustained on examination by the relevant taxing authorities, based on the technical

merits of its position. The tax benefits recognized in the financial statements from such a position are

measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate

settlement. The Company classifies interest and penalties related to income tax matters as a component of

income tax expense.

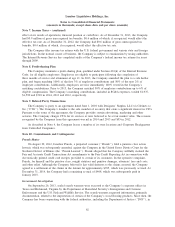

Net Income per Common Share

Basic net income per common share is determined by dividing net income by the weighted average

number of common shares outstanding during the year. Diluted net income per common share is determined

by dividing net income by the weighted average number of common shares outstanding during the year, plus

the dilutive effect of common stock equivalents, including stock options and restricted shares. Common stock

and common stock equivalents included in the computation represent shares issuable upon assumed exercise

of outstanding stock options and release of restricted shares, except when the effect of their inclusion would

be antidilutive.

Recent Accounting Pronouncements

In May 2014, the FASB issued Accounting Standards Update No. 2014-09 (‘‘ASU 2014-09’’), which

creates ASC Topic 606, Revenue from Contracts with Customers, and supersedes the revenue recognition

requirements in Topic 605, Revenue Recognition, including most industry-specific revenue recognition

guidance throughout the Industry Topics of the Codification. In addition, ASU 2014-09 supersedes the cost

guidance in Subtopic 605-35, Revenue Recognition — Construction-Type and Production-Type Contracts, and

creates new Subtopic 340-40, Other Assets and Deferred Costs — Contracts with Customers. In summary, the

core principle of Topic 606 is that an entity recognizes revenue to depict the transfer of promised goods or

services to customers in an amount that reflects the consideration to which the entity expects to be entitled in

exchange for those goods or services. The amendments in ASU 2014-09 are effective for annual reporting

periods beginning after December 15, 2016, including interim periods within that reporting period, and early

application is not permitted. Therefore, the amendments in ASU 2014-09 will become effective for the

Company at the beginning of its 2017 fiscal year. The Company is currently assessing the impact of

implementing the new guidance on its consolidated financial statements.

54