Lumber Liquidators 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

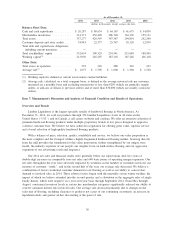

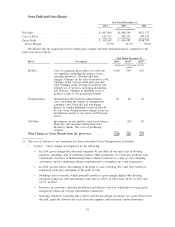

Item 6. Selected Financial Data.

The selected statements of income data for the years ended December 31, 2014, 2013 and 2012 and the

balance sheet data as of December 31, 2014 and 2013 have been derived from our audited consolidated

financial statements included in Item 8. ‘‘Consolidated Financial Statements and Supplementary Data’’ of this

report. This information should be read in conjunction with those audited financial statements, the notes

thereto, and Item 7. ‘‘Management’s Discussion and Analysis of Financial Condition and Results of

Operations’’ of this report.

The selected balance sheet data set forth below as of December 31, 2012, 2011 and 2010, and income

data for the years ended December 31, 2011 and 2010 are derived from our audited consolidated financial

statements contained in reports previously filed with the SEC, which are not included herein. Our historical

results are not necessarily indicative of our results for any future period.

Year Ended December 31,

2014 2013 2012 2011 2010

(dollars in thousands, except per share amounts)

Statement of Income Data

Net sales ................... $ 1,047,419 $ 1,000,240 $ 813,327 $ 681,587 $ 620,281

Comparable store net sales

(decrease) increase

(1)

....... (4.3)% 15.8% 11.4% (2.0%) 2.1%

Cost of sales ................ 629,252 589,257 504,542 440,912 404,451

Gross profit ................. 418,167 410,983 308,785 240,675 215,830

Selling, general and administrative

expenses .................. 314,094 284,960 230,439 198,237 173,667

Operating income ............. 104,073 126,023 78,346 42,438 42,163

Interest expense .............. 84——— —

Other (income) expense

(2)

....... 406 (442) (140) (587) (579)

Income before income taxes ...... 103,583 126,465 78,486 43,025 42,742

Provision for income taxes ....... 40,212 49,070 31,422 16,769 16,476

Net income ................. $ 63,371 $ 77,395 $ 47,064 $ 26,256 $ 26,266

Net income per common share:

Basic .................... $ 2.32 $ 2.82 $ 1.71 $ 0.95 $ 0.96

Diluted ................... $ 2.31 $ 2.77 $ 1.68 $ 0.93 $ 0.93

Weighted average common shares

outstanding:

Basic .................... 27,264,882 27,484,790 27,448,333 27,706,629 27,384,095

Diluted ................... 27,485,852 27,914,322 28,031,453 28,379,693 28,246,453

(1) A store is generally considered comparable on the first day of the thirteenth full calendar month after

opening.

(2) Includes interest income.

29