Logitech 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

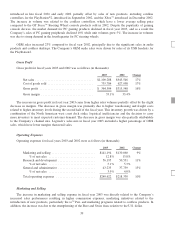

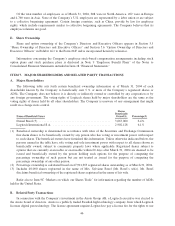

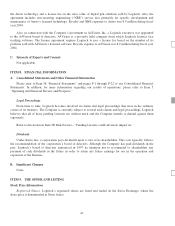

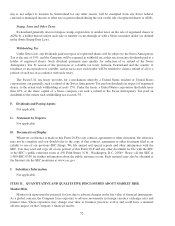

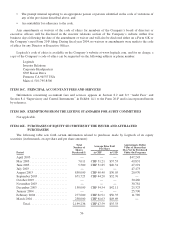

American Depositary Shares.Logitech’s ADSs are traded on the Nasdaq National Market. The following

table sets forth certain historical market price information for the Company’s ADSs.

Price per ADS

on Nasdaq

High Low

Annual Highs and Lows:

Fiscal 2000 ........................................................ $37.50 $ 6.13

Fiscal 2001 ........................................................ $38.25 $18.75

Fiscal 2002 ........................................................ $48.25 $18.12

Fiscal 2003 ........................................................ $53.25 $21.85

Fiscal 2004 ........................................................ $51.30 $27.96

Quarterly Highs and Lows:

Fiscal 2003:

First quarter .................................................... $53.25 $41.35

Second quarter .................................................. $46.03 $22.20

Third quarter ................................................... $38.50 $21.85

Fourth quarter .................................................. $34.78 $29.05

Fiscal 2004:

First quarter .................................................... $42.50 $29.59

Second quarter .................................................. $40.99 $27.96

Third quarter ................................................... $45.05 $31.16

Fourth quarter .................................................. $51.30 $41.40

Monthly Highs and Lows

(over the most recent six month period):

October 2003 ....................................................... $39.64 $31.16

November 2003 ..................................................... $40.50 $38.10

December 2003 ..................................................... $45.05 $40.93

January 2004 ....................................................... $49.60 $41.40

February 2004 ...................................................... $51.30 $47.12

March 2004 ........................................................ $49.44 $43.72

B. Plan of Distribution

Not applicable.

C. Markets

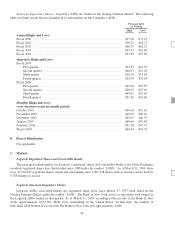

Logitech Registered Shares and Convertible Bonds

The principal trading market for Logitech’s registered shares and convertible bonds is the Swiss Exchange,

on which registered shares have been traded since 1988 under the symbol “LOGN.” As of March 31, 2004, there

were 47,901,655 registered shares issued and outstanding (less 2,902,128 shares held as treasury stock) held by

8,785 holders of record.

Logitech American Depositary Shares

Logitech ADSs, each representing one registered share, have since March 27, 1997 been listed on the

Nasdaq National Market under the symbol “LOGI.” The Bank of New York serves as depositary with respect to

the Logitech ADSs traded on that market. As of March 31, 2004, according to the records of the Bank of New

York, approximately 4,679,761 ADSs were outstanding in the United States. At that date, the number of

individual ADS holders of record with The Bank of New York was approximately 4,880.

49