Logitech 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

infrared codes, technology and brand name. Also, the agreement provides for possible performance-based

payments to the former shareholders of Intrigue tied to the achievement of certain future remote control revenue

targets. The amount of such payments, if any, will not be known until the end of the revenue measurement

period, which may be as late as fiscal year 2008.

The Company believes that its cash and cash equivalents, cash flow generated from operations, and

available borrowings under its bank lines of credit will be sufficient to fund capital expenditures and working

capital needs for the foreseeable future.

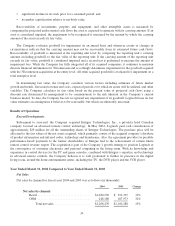

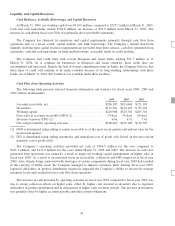

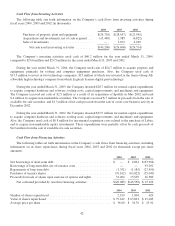

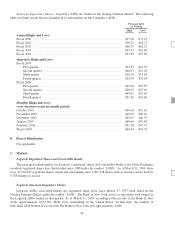

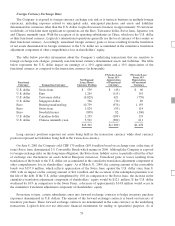

Contractual Obligations and Commitments

The following summarizes Logitech’s contractual obligations and commitments at March 31, 2004, and the

effect such obligations have on liquidity and cash flow in future periods. The Company’s outstanding debt

obligations included: (i) borrowings outstanding on its convertible bonds, (ii) amounts owed on its Swiss

mortgage loan, (iii) amounts drawn on its credit lines and (iv) equipment financed under capital leases (in

thousands).

Total

Year ending March 31,

2005 2006-2007 2008-2009 Thereafter

Convertible bonds ............................. $137,008 $ — $137,008 $ — $ —

Swissmortgageloan ........................... 3,621 3,621 — —

Lines of credit ................................ 10,112 10,112 — — —

Capital leases ................................. 399 399 — — —

Operating leases ............................... 34,400 5,697 9,482 7,897 11,324

Fixedpurchasecommitments–inventory........... 104,643 104,643 — — —

Fixed purchase commitments – capital and other ..... 5,444 4,426 1,018 — —

Other long-term liabilities ....................... 931 — 387 — 544

Total contractual obligations and commitments ...... $296,558 $128,898 $147,895 $7,897 $11,868

For additional information on the Company’s outstanding debt obligations, see Note 7. “Financing

Arrangements” of the Notes to Consolidated Financial Statements.

Lease Commitments

As of March 31, 2004, the Company had total outstanding commitments on non-cancelable operating leases

totaling $34.4 million. Remaining terms on the Company’s operating leases expire in various years through 2015.

Purchase Commitments

The Company has fixed purchase commitments primarily for inventory and capital expenditures. The

inventory purchase commitments are made in the normal course of business and are to original design

manufacturers, contract manufacturers and other suppliers. Commitments for capital expenditures are primarily

for computer hardware and software, warehouse facilities and tooling.

Off-Balance Sheet Arrangements

The Company has not entered into any transactions with unconsolidated entities whereby the Company has

financial guarantees, subordinated retained interests, derivative instruments or other contingent arrangements that

expose it to material continuing risks, contingent liabilities, or any other obligation under a variable interest in an

unconsolidated entity that provides financing, liquidity, market risk or credit risk support to the Company.

Guarantees

The Company has guaranteed the purchase obligations of some of its contract manufacturers and original

design manufacturers to certain component suppliers. These guarantees have a term of one year and are

44