Logitech 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

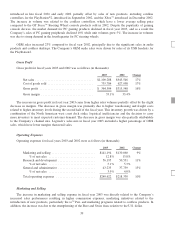

Research and Development

Research and development expense consists of personnel and related overhead costs, contractors and outside

consultants, supplies and materials, equipment depreciation and facilities costs, all associated with the design and

development of new products and enhancements of existing products.

The increase in research and development expense in fiscal year 2004 compared to fiscal year 2003 was

mainly due to increased personnel to support ongoing investment in product development. Specifically, the

Company increased research and development spending for its control device and audio product programs. Also,

the stronger Swiss franc relative to the U.S. dollar contributed to the increase in fiscal year 2004 as the Company

maintains a substantial research and development team in Switzerland.

General and Administrative

General and administrative expense consists primarily of personnel and related overhead and facilities costs

for the finance, information systems, executive, human resources and legal functions.

The increase in general and administrative expense in fiscal year 2004 compared to the prior year was

primarily due to higher personnel expenses to support the growth of Logitech’s business, partially offset by lower

discretionary spending. Also, the stronger Euro and Swiss franc relative to the U.S. dollar further contributed to

the increase in fiscal year 2004.

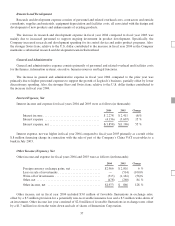

Interest Expense, Net

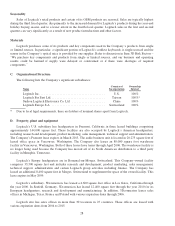

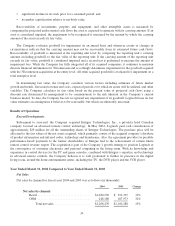

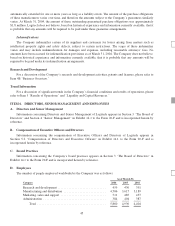

Interest income and expense for fiscal years 2004 and 2003 were as follows (in thousands):

2004 2003 Change

Interest income .................................... $2,278 $2,411 (6)%

Interest expense ................................... (4,136) (3,607) 15 %

Interest expense, net ................................ $(1,858) $(1,196) 55 %

Interest expense, net was higher in fiscal year 2004 compared to fiscal year 2003 primarily as a result of the

$.8 million financing charge in connection with the sale of part of the Company’s China VAT receivables to a

bank in July 2003.

Other Income (Expense), Net

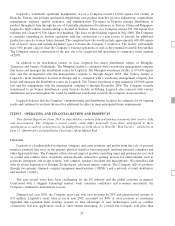

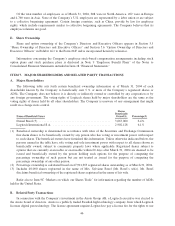

Other income and expense for fiscal years 2004 and 2003 were as follows (in thousands):

2004 2003 Change

Foreign currency exchange gains, net ................... $2,966 $2,801 6%

Loss on sale of investments ........................... — (514) (100)%

Write-off of investments ............................. (515) (1,161) (56)%

Other,net ......................................... (478) (260) 84 %

Otherincome,net .................................. $1,973 $ 866 128%

Other income, net in fiscal year 2004 included $3.0 million of favorable fluctuations in exchange rates,

offset by a $.5 million provision for a potentially non-recoverable insurance loss and a $.5 million write-down of

an investment. Other income last year consisted of $2.8 million of favorable fluctuations in exchange rates offset

by a $1.7 million loss from the write-down and sale of shares of Immersion Corporation.

37