Logitech 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Logitech (Jersey) Ltd., a wholly owned subsidiary of Logitech International S.A., with its registered office

in St. Helier, Jersey, Channel Islands, is the issuer of 1% convertible bonds of CHF 170 million, convertible into

registered shares of Logitech International S.A. (refer to section 2.7 below for more information on Logitech’s

outstanding convertible bonds), which mature in 2006. The convertible bonds are listed on the SWX Swiss

Exchange (Ticker: LOG01; security number: 1236784; ISIN: CH0012367840). As of March 31, 2004, the

carrying amount of the convertible bonds was CHF 174.8 million ($137.0 million) and the fair value based on

quoted market value was CHF 198.9 million ($155.9 million).

Logitech International S.A. directly or indirectly owns 100% of all the companies in the Logitech Group,

through which it carries on its business and operations. Principal operating subsidiaries include: Logitech Europe

S.A., Logitech Far East, Ltd., Logitech, Inc., Suzhou Logitech Electronic Co. Ltd. and 3Dconnexion, Inc. and

GmbH. For a list of Logitech subsidiaries, refer to the table on page CG-24. Except for Logitech (Jersey) Ltd.,

none of Logitech International S.A.’s subsidiaries has securities listed on a stock exchange.

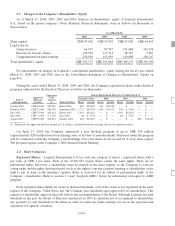

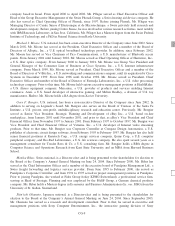

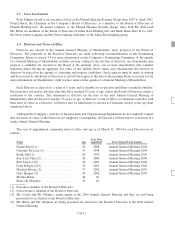

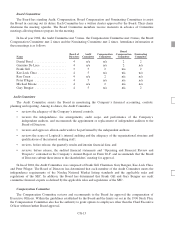

1.2 Significant Shareholders

To the knowledge of the Company, the beneficial owners holding more than 5% of the voting rights of the

Company as of March 31, 2004 were as follows:

Name

Number of

Shares(2)

% of Voting

Rights(3) Relevant Date(4)

DanielandSylvianeBorel(1)........................ 3,067,000 6.4% March 31, 2004

Logitech International S.A. .......................... 2,902,128 6.1% March 31, 2004

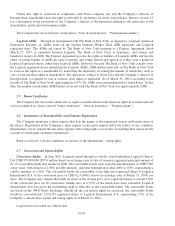

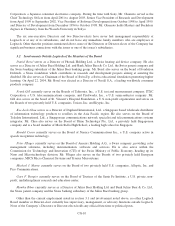

The Swiss Federal Act on Stock Exchanges and Securities Trading of March 24, 1995, or SESTA, requires

shareholders who own voting rights exceeding certain percentage thresholds of a company incorporated in

Switzerland to notify the company and the Swiss Exchange of such holdings. Following receipt of this

notification, the company is required to inform the public. From April 1, 2003 to March 31, 2004, the Company

made the following announcements in compliance with these provisions:

Name

Registered Office /

Address

Number of

Shares(2)

% of Voting

Rights(3)

Date of Publication

in the Swiss

Official Gazette of

Commerce

Logitech International S.A. ....... Apples, Switzerland 2,399,730 5.01% August 26, 2003

Logitech International S.A. ....... Apples, Switzerland 2,379,306 4.69% May 6, 2003

(1) Daniel and Sylviane Borel have not entered into any shareholders’ agreement.

(2) Includes shares represented by ADRs. In compliance with Article 20 of SESTA and Article 13 of the

Ordinance of the Swiss Federal Banking Commission on Stock Exchanges and Securities Trading of

June 25, 1997, or SESTO-FBC, conversion and acquisition rights are not taken into consideration for the

calculation of the relevant shareholdings, unless such rights entitle their holders to acquire, upon exercise, at

least 5% of the Company’s voting rights.

(3) In compliance with Article 19 paragraph 2 of SESTO-FBC, shareholdings are calculated based on the

aggregate number of voting rights entered into the Swiss commercial register. This aggregate number was

47,901,655 voting rights as of March 31, 2004.

(4) For the Company, Directors and Executive Officers, the relevant date is the last day of the fiscal year.

1.3 Cross-shareholdings

Logitech has no shareholdings in companies that to its knowledge have shareholdings in the Company.

CG-3