Logitech 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• significant decline in its stock price for a sustained period; and

• its market capitalization relative to net book value.

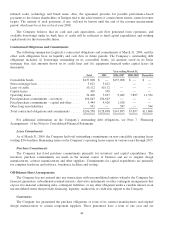

Recoverability of investments, property and equipment, and other intangible assets is measured by

comparing the projected undiscounted cash flows the asset is expected to generate with its carrying amount. If an

asset is considered impaired, the impairment to be recognized is measured by the amount by which the carrying

amount of the asset exceeds its fair value.

The Company evaluates goodwill for impairment on an annual basis and whenever events or changes in

circumstances indicate that the carrying amount may not be recoverable from its estimated future cash flows.

Recoverability of goodwill is measured at the reporting unit level by comparing the reporting unit’s carrying

amount, including goodwill, to the fair value of the reporting unit. If the carrying amount of the reporting unit

exceeds its fair value, goodwill is considered impaired and a second test is performed to measure the amount of

impairment loss. While the Company has fully integrated all of its acquired companies, it continues to maintain

discrete financial information for 3Dconnexion and accordingly determines impairment for the goodwill acquired

with the 3Dconnexion acquisition at the entity level. All other acquired goodwill is evaluated for impairment on a

total enterprise level.

In determining fair value, the Company considers various factors including estimates of future market

growth and trends, forecasted revenue and costs, expected periods over which its assets will be utilized, and other

variables. The Company calculates its fair value based on the present value of projected cash flows using a

discount rate determined by management to be commensurate to the risk inherent in the Company’s current

business model. To date, the Company has not recognized any impairment of its goodwill. Logitech bases its fair

value estimates on assumptions it believes to be reasonable, but which are inherently uncertain.

Results of Operations

Recent Developments

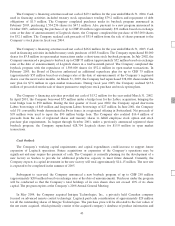

Subsequent to year-end, the Company acquired Intrigue Technologies, Inc., a privately held Canadian

company focused on advanced remote control technology. In May 2004, Logitech paid cash consideration of

approximately $29 million for all the outstanding shares of Intrigue Technologies. The purchase price will be

allocated to the fair values of the net assets acquired, which primarily consist of the acquired company’s database

of product information and infrared codes, technology and brand name. Also, the agreement provides for possible

performance-based payments to the former shareholders of Intrigue tied to the achievement of certain future

remote control revenue targets. The acquisition is part of the Company’s growth strategy to position Logitech at

the convergence of consumer electronics and personal computing in the living room. With its knowledge and

experience in control devices for the PC and game consoles, combined with Intrigue’s expertise and technology

in advanced remote controls, the Company believes it is well positioned to further its presence in the digital

living room, around the home entertainment center, including the TV, the DVD player and the VCR player.

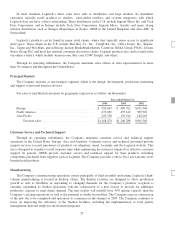

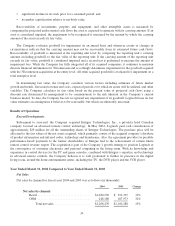

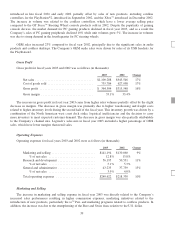

Year Ended March 31, 2004 Compared to Year Ended March 31, 2003

Net Sales

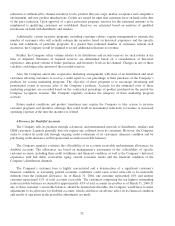

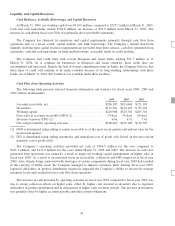

Net sales by channel for fiscal years 2004 and 2003 was as follows (in thousands):

2004 2003 Change

Net sales by channel:

Retail .................................. $1,020,290 $ 912,315 12%

OEM .................................. 248,180 187,973 32%

Total net sales ....................... $1,268,470 $1,100,288 15%

34