Logitech 2004 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

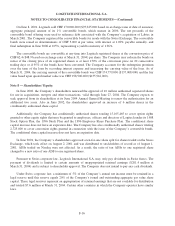

Note 3 — Acquisitions

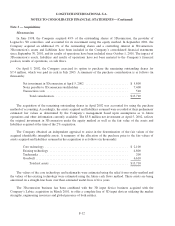

3Dconnexion

In June 1998, the Company acquired 49% of the outstanding shares of 3Dconnexion, the provider of

Logitech’s 3D controllers, and accounted for its investment using the equity method. In September 2001, the

Company acquired an additional 2% of the outstanding shares and a controlling interest in 3Dconnexion.

3Dconnexion’s assets and liabilities have been included in the Company’s consolidated financial statements

since September 30, 2001, and its results of operations have been included since October 1, 2001. The impact of

3Dconnexion’s assets, liabilities and results of operations have not been material to the Company’s financial

position, results of operations, or cash flows.

On April 5, 2002, the Company exercised its option to purchase the remaining outstanding shares for

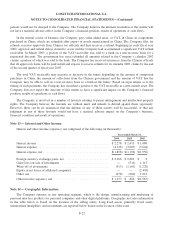

$7.4 million, which was paid in cash in July 2003. A summary of the purchase consideration is as follows (in

thousands):

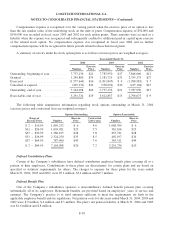

Net investment in 3Dconnexion at April 5, 2002 ........................... $ 5,800

Notes payable to 3Dconnexion stockholders ............................... 7,400

Transaction costs .................................................... 510

Total consideration ............................................... $13,710

The acquisition of the remaining outstanding shares in April 2002 was accounted for using the purchase

method of accounting. Accordingly, the assets acquired and liabilities assumed were recorded at their preliminary

estimated fair values as determined by the Company’s management based upon assumptions as to future

operations and other information currently available. The $5.8 million net investment at April 5, 2002, reflects

the original investment in 3Dconnexion under the equity method as well as the fair value of the assets and

liabilities acquired at the time of the 2% acquisition.

The Company obtained an independent appraisal to assist in the determination of the fair values of the

acquired identifiable intangible assets. A summary of the allocation of the purchase price to the fair values of

assets acquired and liabilities assumed in the acquisition is as follows (in thousands):

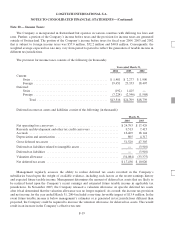

Core technology ..................................................... $ 2,100

Existing technology .................................................. 4,800

Trademarks......................................................... 200

Goodwill ........................................................... 6,610

Total net assets .................................................. $13,710

The values of the core technology and trademarks were estimated using the relief from royalty method and

the values of the existing technology were estimated using the future cash flows method. These assets are being

amortized on a straight-line basis over their estimated useful lives of five years.

The 3Dconnexion business has been combined with the 3D input device business acquired with the

Company’s Labtec acquisition in March 2001, to offer a complete line of 3D input devices utilizing the market

strengths, engineering resources and global presence of both entities.

F-12