Logitech 2004 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

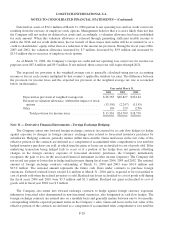

hedged receivable is settled, at which time the gains or losses are reclassified to other income (expense). The

notional amount of foreign exchange contracts outstanding at March 31, 2004 was $3.5 million and none at

March 31, 2003. Deferred losses on the contracts recorded in accumulated other comprehensive loss were

immaterial as of March 31, 2004.

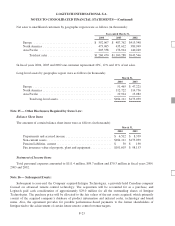

Note 12 — Commitments and Contingencies:

The Company leases facilities under operating leases, certain of which require it to pay property taxes,

insurance and maintenance costs. Operating leases for facilities are generally renewable at the Company’s option

and usually include escalation clauses linked to inflation. Future minimum annual rentals at March 31, 2004 are

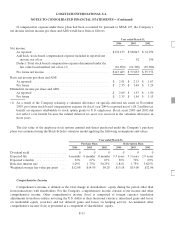

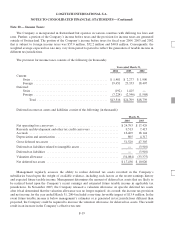

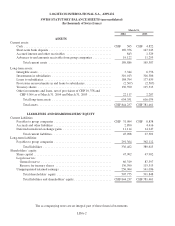

as follows (in thousands):

Year ending March 31,

2005 .......................................................... $ 5,697

2006 .......................................................... 5,312

2007 .......................................................... 4,170

2008 .......................................................... 4,265

2009 .......................................................... 3,632

Thereafter ...................................................... 11,324

$34,400

Rent expense was $6.9 million, $6.3 million and $5.2 million during the years ended March 31, 2004, 2003

and 2002.

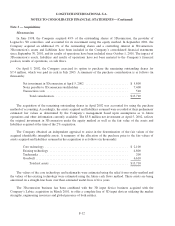

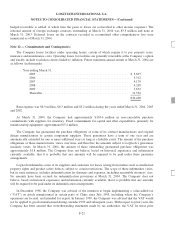

At March 31, 2004, the Company had approximately $104.6 million in non-cancelable purchase

commitments with suppliers for inventory. Fixed commitments for capital and other expenditures, primarily for

manufacturing equipment, approximated $5.4 million.

The Company has guaranteed the purchase obligations of some of its contract manufacturers and original

design manufacturers to certain component suppliers. These guarantees have a term of one year and are

automatically extended for one or more additional years as long as a liability exists. The amount of the purchase

obligations of these manufacturers varies over time, and therefore the amounts subject to Logitech’s guarantees

similarly varies. At March 31, 2004, the amount of these outstanding guaranteed purchase obligations was

approximately $1.8 million. The Company does not believe, based on historical experience and information

currently available, that it is probable that any amounts will be required to be paid under these guarantee

arrangements.

Logitech indemnifies some of its suppliers and customers for losses arising from matters such as intellectual

property rights and product safety defects, subject to certain restrictions. The scope of these indemnities varies,

but in some instances, includes indemnification for damages and expenses, including reasonable attorneys’ fees.

No amounts have been accrued for indemnification provisions at March 31, 2004. The Company does not

believe, based on historical experience and information currently available, that it is probable that any amounts

will be required to be paid under its indemnification arrangements.

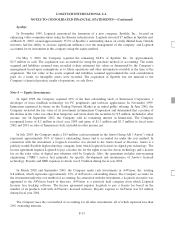

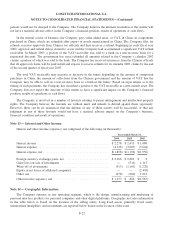

In December 1996, the Company was advised of the intention to begin implementing a value-added tax

(“VAT”) on goods manufactured in certain parts of China since July 1995, including where the Company’s

operations are located, and intended for export. In January 1999, the Company was advised that the VAT would

not be applied to goods manufactured during calendar 1999 and subsequent years. With respect to prior years, the

Company has been assured that, notwithstanding statements made by tax authorities, the VAT for these prior

F-21