Logitech 2004 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A., APPLES

NOTES TO SWISS STATUTORY FINANCIAL STATEMENTS

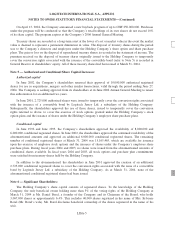

Note 1 — Basis of Presentation:

The Swiss statutory financial statements of Logitech International S.A. (“the Holding Company”) are

prepared in accordance with Swiss Law. The financial statements present the financial position and results of

operations of the Holding Company on a standalone basis and do not represent the consolidated financial position

of the Holding Company and its subsidiaries.

Certain amounts reported in prior years’ financial statements have been reclassified to conform to the

current year presentation.

Note 2 — Contingent Liabilities:

Logitech International S.A. issued guarantees to a bank for CHF 20,000,000 for lines of credit available to

its subsidiaries. At March 31, 2004 the aforementioned lines of credit were not drawn down.

Logitech International S.A. purchases foreign exchange contracts for and on behalf of an operating

subsidiary. The notional amount of foreign exchange contracts outstanding at March 31, 2004 was

CHF 13,267,000. The notional amount represents the future cash flows under contracts to purchase foreign

currencies. Net unrecognized gains totaled CHF 477,000 at March 31, 2004. Gains or losses on such contracts

will be transferred to the operating subsidiary on maturity.

Note 3 — Investments:

Principal operating subsidiaries include the following: Logitech Europe S.A., Logitech Far East Ltd.,

Logitech Inc., and Suzhou Logitech Electronic Co. Ltd. All subsidiaries are directly or indirectly 100% owned by

the Holding Company.

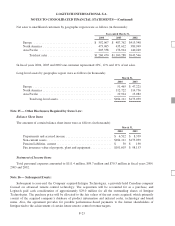

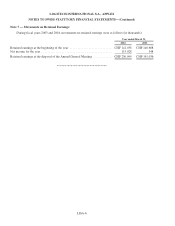

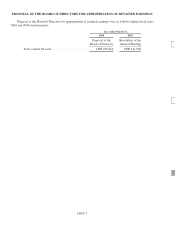

Note 4 — Treasury Shares:

During fiscal years 2003 and 2004, repurchases of and issuances from the Company’s treasury shares were

as follows (total cost in thousands):

Number of

shares Total cost

Held by the holding company at March 31, 2002 ........................... 2,083,003 CHF 28,515

Additions ...................................................... 1,835,707 91,569

Disposals ...................................................... (1,463,853) (4,771)

Held by the holding company at March 31, 2003 ........................... 2,454,857 CHF 115,313

Additions ...................................................... 2,199,236 105,019

Disposals ...................................................... (1,751,965) (83,742)

Held by the holding company at March 31, 2004 ........................... 2,902,128 CHF 136,590

On October 2003, the Board of Directors authorized the repurchase of up to CHF 40,000,000 of the Holding

Company’s registered shares/ADSs. This program expired in March 2004 upon completion of the purchase of

665,000 registered shares. A similar program approved in February 2003 was completed in September 2003

when the Holding Company repurchased 1,772,236 million registered shares for approximately CHF 75,000,000.

LISA-4