Logitech 2004 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Deferred tax assets of $34.1 million at March 31, 2004 pertain to net operating loss and tax credit carryovers

resulting from the exercise of employee stock options. Management believes that it is more likely than not that

the Company will not realize its deferred tax assets and, accordingly, a valuation allowance has been established

for such amount. When this valuation allowance is released through generating sufficient taxable income to

utilize the NOL and tax credit deductions, the tax benefit of these losses and credits will be accounted for as a

credit to shareholders’ equity rather than as a reduction of the income tax provision. During the fiscal years 2004,

2003 and 2002, the valuation allowance increased by $.7 million, decreased by $3.9 million and increased by

$13.0 million due to exercises of employee stock options.

As of March 31, 2004, the Company’s foreign tax credit and net operating loss carryovers for income tax

purposes were $67.6 million and $9.5 million. If not utilized, these carryovers will expire through 2024.

The expected tax provision at the weighted average rate is generally calculated using pre-tax accounting

income or loss in each country multiplied by that country’s applicable statutory tax rates. The difference between

the provision for income taxes and the expected tax provision at the weighted average tax rate is reconciled

below (in thousands):

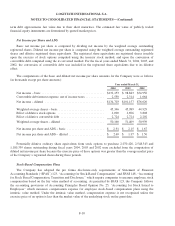

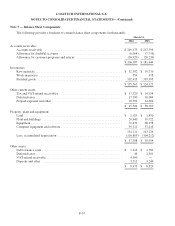

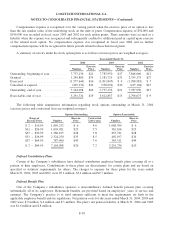

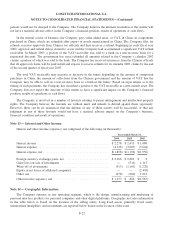

Year ended March 31,

2004 2003 2002

Expected tax provision at weighted average rate .......... $26,763 $26,827 $20,144

Decrease in valuation allowance, without the impact of stock

options......................................... (13,350) (2,247) (1,155)

Other ............................................ 103 129 (250)

Total provision for income taxes .................. $13,516 $24,709 $18,739

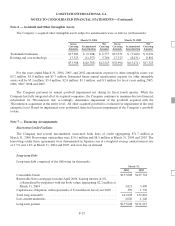

Note 11 — Derivative Financial Instruments – Foreign Exchange Hedging:

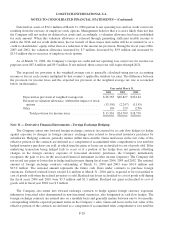

The Company enters into forward foreign exchange contracts (accounted for as cash flow hedges) to hedge

against exposure to changes in foreign currency exchange rates related to forecasted inventory purchases by

subsidiaries. Hedging contracts generally mature within three months. Gains and losses in the fair value of the

effective portion of the contracts are deferred as a component of accumulated other comprehensive loss until the

hedged inventory purchases are sold, at which time the gains or losses are reclassified to cost of goods sold. If the

underlying transaction being hedged fails to occur or if a portion of the hedge does not generate offsetting

changes in the foreign currency exposure of forecasted inventory purchases, the Company immediately

recognizes the gain or loss on the associated financial instrument in other income (expense). The Company did

not record any gains or losses due to hedge ineffectiveness during fiscal years 2004, 2003 and 2002. The notional

amount of foreign exchange contracts outstanding at March 31, 2004 and 2003 were $10.4 million and

$13.0 million. The notional amount represents the future cash flows under contracts to purchase foreign

currencies. Deferred realized losses totaled $.4 million at March 31, 2004 and is expected to be reclassified to

cost of goods sold when the related inventory is sold. Realized net losses reclassified to cost of goods sold during

the fiscal years 2004 and 2003 were $3.5 million and $1.1 million. Realized net gains reclassified to cost of

goods sold in fiscal year 2002 was $.3 million.

The Company also enters into forward exchange contracts to hedge against foreign currency exposures

inherent in forecasted sales denominated in non-functional currencies, also designated as cash flow hedges. The

foreign exchange contracts are entered into on a monthly basis and generally mature between one to two months,

corresponding with the expected payment terms on the Company’s sales. Gains and losses in the fair value of the

effective portion of the contracts are deferred as a component of accumulated other comprehensive loss until the

F-20