Logitech 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

managers and freight forwarders. During the first half of fiscal year 2005, we expect to complete our transition to

a new third-party distribution center in Europe (Venray, Netherlands) and will be starting up an additional third-

party distribution center in Eastern Europe (Hungary). On a worldwide basis, we will continue to evaluate and

consider changes in both our international and domestic freight forwarders. If we do not successfully coordinate

these changes and the timely manufacture and distribution of our products, we may have insufficient supply of

products to meet customer demand and could lose sales, or we may experience a build-up in inventory.

We are currently expanding our Suzhou manufacturing operations with the construction of a new factory to

provide for additional productive capacity to meet future demand. We expect construction of the new site to be

completed and operations to commence in the summer of 2005. If construction and transition of manufacturing to

the new factory were to be significantly delayed, we may not have sufficient productive capacity to meet

customer demand, and as a result could lose sales.

A significant portion of our quarterly orders and product deliveries occur in the last month of the fiscal

quarter, generally with a high concentration in the final week of that month. This places pressure on our supply

chain and could adversely impact our revenues and profitability if we are unable to successfully fulfill all our

orders from our customers in the quarter.

We conduct operations in a number of countries and the effect of business, legal and political risks

associated with international operations could significantly harm us.

We conduct operations in a number of countries. There are risks inherent in doing business in international

markets, including:

• difficulties in staffing and managing international operations;

• compliance with laws and regulations, including environmental laws, which vary from country to

country and over time, increasing the costs of compliance and potential risks of non-compliance;

• exposure to political and financial instability, leading to currency exchange losses, collection difficulties

or other losses;

• exposure to fluctuations in the value of local currencies;

• changes in value-added tax or VAT reimbursement;

• imposition of currency exchange controls; and

• delays from customs brokers or government agencies.

Any of these risks could significantly harm our business, financial condition and operating results.

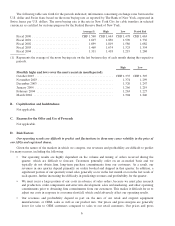

We have accumulated a significant VAT refund receivable from the Chinese government and if we do not

recover this receivable, our gross margins and operating results could be adversely affected.

In the normal course of business, we pay value-added taxes, or VAT, in China on components we purchase

in China, which are refunded after the export of goods manufactured in China. We file for refunds, receive

approvals from the Chinese tax officials and then receive our refund. Beginning in early fiscal year 2002,

approval and refund delays started to occur. As a result, we have accumulated a significant VAT refund

receivable that will continue to grow to the extent that our future VAT payments exceed amounts reimbursed by

the Chinese government or sold to third parties. In March and July 2003, we sold a portion of our VAT

receivable to a bank on a non-recourse basis for a negotiated discount. The government has since refunded all

amounts related to our calendar 2002 claims, a portion of which was sold to the bank. We have received

assurances from the Chinese officials that all approved claims will be paid in full, and that we can expect to

receive refunds for our calendar 2003 claims by the end of the second quarter of fiscal year 2005. If we are

unable to collect our VAT receivable for any reason, or if we are unable to negotiate similar non-recourse sales

11