Logitech 2004 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

introduced in late fiscal 2001 and early 2002 partially offset by sales of new products, including cordless

controllers for the PlayStation®2, introduced in September 2002, and the Xbox™introduced in December 2002.

The increase in volume was related to the cordless controllers, which have a lower average selling price

compared to the GT Force™Steering Wheel console products sold in 2002. Despite the popularity of gaming

console devices, the market demand for PC gaming products declined in fiscal year 2003, and as a result the

Company’s sales of PC gaming peripherals declined 10% while unit volumes grew 5%. The increase in volumes

was due to strong demand in the fourth quarter for PC steering wheels.

OEM sales increased 23% compared to fiscal year 2002, principally due to the significant sales in audio

products and cordless desktops. The Company’s OEM audio sales were driven by sales of its USB headsets for

the PlayStation2.

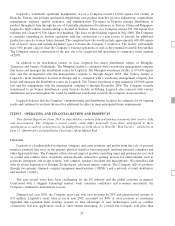

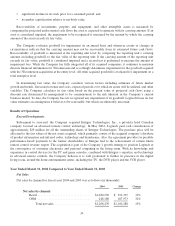

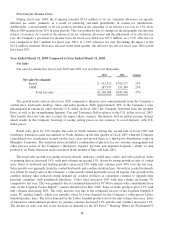

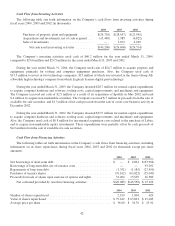

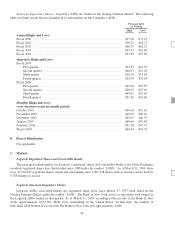

Gross Profit

Gross profit for fiscal years 2003 and 2002 was as follows (in thousands):

2003 2002 Change

Net sales ..................................... $1,100,288 $943,546 17%

Cost of goods sold ............................. 735,784 627,998 17%

Grossprofit .................................. $ 364,504 $315,548 16%

Grossmargin ................................. 33.1% 33.4%

The increase in gross profit in fiscal year 2003 came from higher sales volumes partially offset by the slight

decrease in margins. The decrease in gross margin was primarily due to higher warehousing and freight costs

related to higher inventory levels during the second half of the fiscal year. This inventory growth was driven by a

combination of the North American west coast dock strike, logistical inefficiencies and the decision to carry

more inventory to meet expected customer demand. The decrease in gross margin was also partially attributable

to the Company’s channel mix. Logitech’s sales mix in fiscal year 2003 included a higher percentage of OEM

sales, which have lower margins than retail sales.

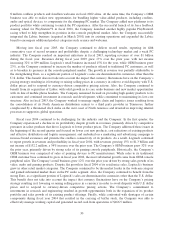

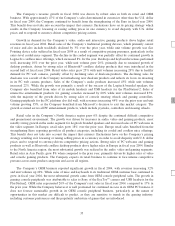

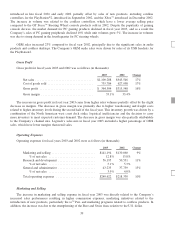

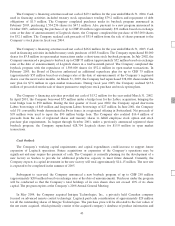

Operating Expenses

Operating expenses for fiscal years 2003 and 2002 were as follows (in thousands):

2003 2002 Change

Marketing and selling ............................ $141,194 $130,060 9%

% of net sales .............................. 12.8% 13.8%

Research and development ........................ 56,195 50,531 11%

% of net sales .............................. 5.1% 5.3%

General and administrative ........................ 43,233 37,739 15%

% of net sales .............................. 3.9% 4.0%

Total operating expenses ......................... $240,622 $218,330 10%

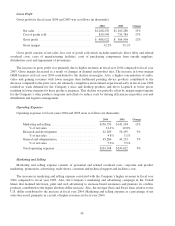

Marketing and Selling

The increase in marketing and selling expense in fiscal year 2003 was directly related to the Company’s

increased sales performance resulting in higher commission expenses, marketing initiatives related to the

introduction of new products, particularly the io™Pen, and marketing programs related to cordless products. In

addition, the increase was due to the strengthening of the Euro and Swiss franc relative to the U.S. dollar.

39