Logitech 2004 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

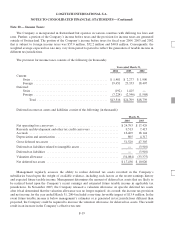

Note 10 — Income Taxes:

The Company is incorporated in Switzerland but operates in various countries with differing tax laws and

rates. Further, a portion of the Company’s income before taxes and the provision for income taxes are generated

outside of Switzerland. The portion of the Company’s income before taxes for fiscal year 2004, 2003 and 2002

that is subject to foreign income taxes was $57.0 million, $52.2 million and $40.8 million. Consequently, the

weighted average expected tax rate may vary from period to period to reflect the generation of taxable income in

different tax jurisdictions.

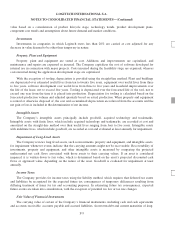

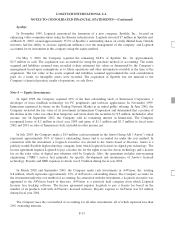

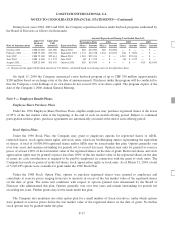

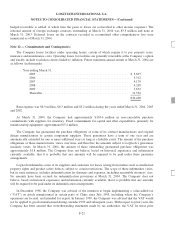

The provision for income taxes consists of the following (in thousands):

Year ended March 31,

2004 2003 2002

Current:

Swiss................................................. $ 1,481 $ 2,277 $ 1,900

Foreign ............................................... 19,451 23,353 18,407

Deferred:

Swiss................................................. (192) 1,425 —

Foreign ............................................... (7,224) (2,346) (1,568)

Total ............................................. $13,516 $24,709 $18,739

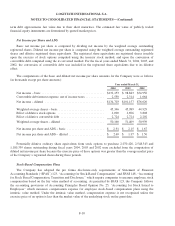

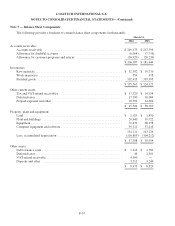

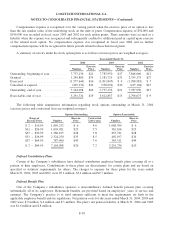

Deferred income tax assets and liabilities consist of the following (in thousands):

March 31,

2004 2003

Net operating loss carryovers ......................................... $24,793 $17,429

Research and development and other tax credit carryovers .................. 9,513 7,415

Accruals ......................................................... 16,409 18,144

Depreciation and amortization ........................................ 805 4,317

Gross deferred tax assets ............................................ 51,520 47,305

Deferred tax liabilities related to intangible assets ......................... — (3,910)

Deferred tax liabilities .............................................. — (3,910)

Valuation allowance ................................................ (34,084) (33,375)

Net deferred tax assets .............................................. $17,436 $10,020

Management regularly assesses the ability to realize deferred tax assets recorded in the Company’s

subsidiaries based upon the weight of available evidence, including such factors as the recent earnings history

and expected future taxable income. Management determines the amount of deferred tax assets that are likely to

be realized based upon the Company’s recent earnings and estimated future taxable income in applicable tax

jurisdictions. In November 2003, the Company released a valuation allowance on specific deferred tax assets

after it had determined that the valuation allowance was no longer required. As a result, the income tax provision

and net income for the year ended March 31, 2004 included a one-time favorable impact of $13.4 million. In the

event future taxable income is below management’s estimates or is generated in tax jurisdictions different than

projected, the Company could be required to increase the valuation allowance for deferred tax assets. This would

result in an increase in the Company’s effective tax rate.

F-19