Logitech 2004 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2004 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

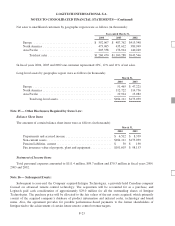

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

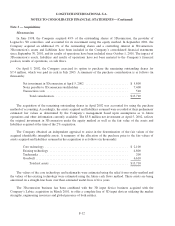

Spotlife

In November 1999, Logitech announced the formation of a new company, Spotlife, Inc., focused on

enhancing video communications using the Internet infrastructure. Logitech invested $7 million in Spotlife and,

at March 31, 2002, owned approximately 35.2% of Spotlife’s outstanding shares on a fully diluted basis. Outside

investors had the ability to exercise significant influence over the management of the company, and Logitech

accounted for its investment in this company using the equity method.

On May 3, 2002, the Company acquired the remaining 64.8% of Spotlife, Inc. for approximately

$2.5 million in cash. The acquisition was accounted for using the purchase method of accounting. The assets

acquired and liabilities assumed were recorded at their estimated fair values as determined by the Company’s

management based upon assumptions as to future operations and other information available at the time of the

acquisition. The fair value of the assets acquired and liabilities assumed approximated the cash consideration

paid. As a result, no intangible assets were recorded. The acquisition of Spotlife was not material to the

Company’s financial position, results of operations, or cash flows.

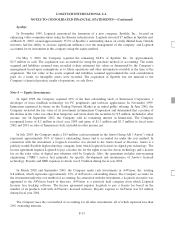

Note 4 — Equity Investments:

In April 1998, the Company acquired 10% of the then outstanding stock of Immersion Corporation, a

developer of force feedback technology for PC peripherals and software applications. In November 1999,

Immersion registered its shares on the Nasdaq National Market in an initial public offering. In June 2002, the

Company reviewed the fair value of its investment in Immersion Corporation and determined that a portion of

the decline in the value was other than temporary and wrote down the securities by $.5 million, included in other

income, net. In September 2002, the Company sold its remaining interest in Immersion. The Company

recognized losses of $.2 million in fiscal year 2003 and gains of $1.1 million and $1.3 million in fiscal years

2002 and 2001 on sales of Immersion stock, included in other income, net.

In July 2003, the Company made a $15 million cash investment in the Anoto Group AB (“Anoto”) which

represents approximately 10% of Anoto’s outstanding shares and is accounted for under the cost method. In

connection with the investment, a Logitech executive was elected to the Anoto board of directors. Anoto is a

publicly traded Swedish high technology company from which Logitech licenses its digital pen technology. The

license agreement requires Logitech to pay a license fee for the rights to use the Anoto technology and a license

fee on the sales value of digital pen solutions sold by Logitech. Also, the agreement includes non-recurring

engineering (“NRE”) service fees primarily for specific development and maintenance of Anoto’s licensed

technology. Royalty and NRE expenses to Anoto was $.9 million during fiscal year 2004.

In March 2002 and September 2003, the Company made cash investments in A4Vision, Inc. totaling

$.8 million, which represents approximately 12% of A4Vision’s outstanding shares. The Company accounts for

the investment under the cost method of accounting. In connection with the investment, a Logitech executive was

appointed to the A4Vision board of directors. A4Vision is a privately held company from which Logitech

licenses face tracking software. The license agreement requires Logitech to pay a license fee based on the

number of its products sold with A4Vision’s licensed software. Royalty expense to A4Vision was $.2 million

during fiscal year 2004.

The Company uses the cost method of accounting for all other investments, all of which represent less than

20% ownership interests.

F-13