LinkedIn 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

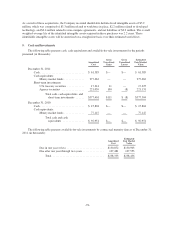

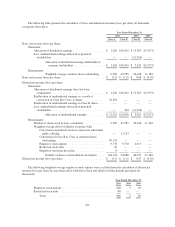

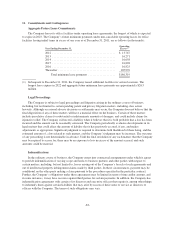

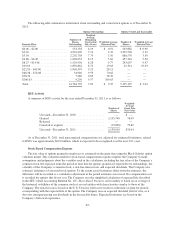

Common Stock Reserved for Future Issuance

As of December 31, 2011, the Company had reserved the following shares of common stock for future

issuances in connection with the following:

Options outstanding ................................... 14,784,701

Restricted stock units outstanding ........................ 1,139,910

Available for future stock option and restricted stock unit

grants ............................................ 12,585,455

Available for future employee stock purchase plan options .... 3,335,633

Total available for future issuance ........................... 31,845,699

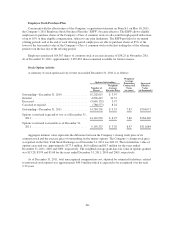

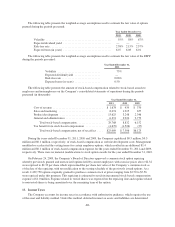

Equity Incentive Plans

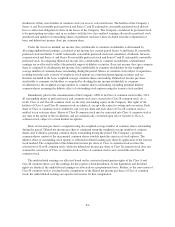

The Company has two equity incentive plans: the Amended and Restated 2003 Stock Incentive Plan (the

“2003 Plan”) and the 2011 Equity Incentive Plan (the “2011 Plan”). Under the 2003 Plan, 34,814,756 shares of

common stock were reserved for the issuance of incentive stock options (“ISOs”), nonstatutory stock options

(“NSOs”), or to eligible participants as of December 31, 2010. Upon the IPO, 2,000,000 shares were initially

reserved under the 2011 Plan and all shares that were reserved under the 2003 Plan but not issued were assumed

by the 2011 Plan. Following the IPO, any shares subject to options or other similar awards granted under the

2003 Plan that expire, are forfeited, are repurchased by us or otherwise terminate unexercised will become

available under the 2011 Plan. As of December 31, 2011 the total number of shares available under the 2011 Plan

is 29,300,703 shares. No additional shares will be issued under the 2003 Plan. Under the 2011 Plan, the Company

has the ability to issue ISOs, NSOs, stock appreciation rights, restricted stock, restricted stock units (“RSUs”),

performance units and/or performance shares. The ISOs and NSOs will be granted at a price per share not less

than the fair value at date of grant. Options granted to date generally vest over a four-year period with 25%

vesting at the end of one year and the remaining vest monthly thereafter. Options granted generally are

exercisable up to 10 years. The Company began granting RSUs in June 2011, which generally vest over a four-

year period with 25% vesting at the end of one year and the remaining vest quarterly thereafter.

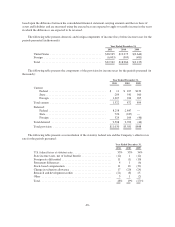

Early Exercise of Stock Options

The Company typically allows employees to exercise options granted under the 2003 Plan prior to vesting.

The unvested shares are subject to the Company’s repurchase right at the original purchase price. The proceeds

initially are recorded as an accrued liability from the early exercise of stock options (see Note 8, Accrued

Liabilities), and reclassified to common stock as the Company’s repurchase right lapses. The Company has

issued common stock of approximately 980,000 and 655,000 shares during the years ended December 31, 2011

and 2010, respectively, for stock options exercised prior to vesting. During the years ended December 31, 2011

and 2010, the Company repurchased 21,830 and 233,812 shares, respectively, of common stock related to

unvested stock options, at the original exercise price due to the termination of employees. At December 31, 2011

and 2010, 789,137 and 981,172 shares held by employees and directors were subject to repurchase at an

aggregate price of $4.8 million and $3.6 million, respectively.

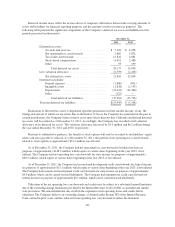

On March 3, 2009, the Company’s Board of Directors approved an executive loan program. The program

allowed certain executives of the Company to exercise options to purchase common stock of the Company

granted to them by executing promissory notes payable to the Company in an aggregate principal amount not to

exceed $0.8 million per participating executive. The loan program contained provisions to ensure compliance

with federal securities laws, which prohibit companies from extending credit to certain executives. The Company

had the right to repurchase some or all of the shares by cancellation of the notes in advance of filing a registration

statement with the SEC. As of December 31, 2010, $3.6 million of promissory notes payable to the Company

were outstanding, but not recorded within the consolidated balance sheet as the notes were considered in

substance non-recourse. There were no promissory notes outstanding as of December 31, 2011 as they were

repaid in full during 2011.

-85-