LinkedIn 2011 Annual Report Download - page 88

Download and view the complete annual report

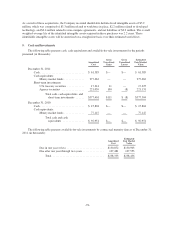

Please find page 88 of the 2011 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.12. Redeemable Convertible Preferred Stock and Stockholders’ Equity

Initial Public Offering

In May 2011, the Company closed its IPO of 9,016,000 shares of its Class A common stock, which included

6,003,804 shares of Class A common stock sold by the Company (inclusive of 1,176,000 shares of Class A

common stock from the full exercise of the overallotment option of shares granted to the underwriters) and

3,012,196 shares of Class A common stock sold by the selling stockholders. The public offering price of the

shares sold in the offering was $45.00 per share. The Company did not receive any proceeds from the sales of

shares by the selling stockholders. The total gross proceeds from the offering to the Company were $270.2

million. After deducting underwriting discounts and commissions and offering expenses payable by the

Company, the aggregate net proceeds received by the Company totaled approximately $248.4 million.

Follow-on Offering

In November 2011, the Company closed its follow-on offering of 10,062,500 shares of its Class A common

stock, which included 2,583,755 shares of Class A common stock sold by the Company (inclusive of 1,312,500

shares of Class A common stock from the full exercise of the overallotment option of shares granted to the

underwriters) and 7,478,745 shares of Class A common stock sold by the selling stockholders. The public

offering price of the shares sold in the offering was $71.00 per share. The Company did not receive any proceeds

from the sales of shares by the selling stockholders. The total gross proceeds from the offering to the Company

were $178.1 million. After deducting underwriting discounts and commissions and offering expenses payable by

the Company, the aggregate net proceeds received by the Company totaled approximately $177.3 million.

Preferred Stock

Prior to its IPO, the Company had outstanding 17,238,579 shares designated as Series A convertible

preferred stock, 17,450,991 shares designated as Series B convertible preferred stock, 4,357,644 designated as

Series C redeemable convertible preferred stock and 6,599,987 designated as Series D redeemable convertible

preferred stock. Each share of preferred stock was convertible into one share of common stock. Immediately

prior to the completion of the Company’s IPO on May 19, 2011, all shares of outstanding preferred stock

automatically converted into 45,647,201 shares of the Company’s Class B common stock.

Warrant

In connection with the line of credit agreement, on September 20, 2004, the Company issued a warrant to

purchase 70,365 shares of Series A convertible preferred stock with an exercise price of $0.32 per share. The fair

value of the warrant, based on an option valuation model, which approximates a binomial lattice model, was

insignificant and was reflected as a discount to borrowings under the financing. The warrant was exercisable for

seven years from the date of issuance. In May 2010, the warrant was exercised. As a result, the Company issued

70,365 shares of Series A convertible preferred stock and received an insignificant amount of proceeds.

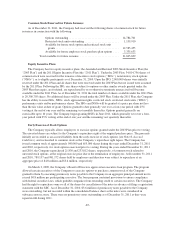

Common Stock

At December 31, 2010, there were 120,000,000 shares of common stock authorized, and 43,308,742 shares

issued and outstanding. Following its IPO on May 19, 2011, the Company had two classes of authorized common

stock outstanding; Class A common stock and Class B common stock. As of December 31, 2011, there were

40,637,575 shares and 60,842,819 shares of Class A common stock and Class B common stock, respectively,

issued and outstanding.

-84-