LinkedIn 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

underwriters. We raised approximately $248.4 million in net proceeds after deducting underwriting discounts and

commissions of approximately $17.9 million and other offering expenses of approximately $3.8 million. No

payments were made by us to directors, officers or persons owning ten percent or more of our common stock or to

their associates, or to our affiliates, other than payments in the ordinary course of business to officers for salaries, or

as a result of sales of shares of common stock by selling stockholders in the offering.

On November 22, 2011, we closed our follow-on offering, in which we sold 2,583,755 shares of Class A

common stock at a price to the public of $71.00 per share. The aggregate offering price for shares sold in the

offering was approximately $183.4 million. The offer and sale of all of the shares in the follow-on offering were

registered under the Securities Act pursuant to a registration statement on Form S-1 (File No. 333-177710),

which was declared effective by the SEC on November 16, 2011. The offering commenced as of November 16,

2011 and did not terminate before all of the securities registered in the registration statement were sold. Morgan

Stanley & Co. Incorporated, Merrill Lynch, Pierce, Fenner & Smith Incorporated, J.P. Morgan Securities LLC,

Allen & Company LLC and UBS Securities LLC acted as the underwriters. We raised approximately $177.3

million in net proceeds after deducting underwriting discounts and commissions of approximately $5.3 million

and other offering expenses of approximately $0.8 million. No payments were made by us to directors, officers

or persons owning ten percent or more of our common stock or to their associates, or to our affiliates, other than

payments in the ordinary course of business to officers for salaries, or as a result of sales of shares of common

stock by selling stockholders in the offering.

The proceeds from the IPO and our follow-on offering have been used for working capital, sales and

marketing activities, including further expansion of our product development and field sales organizations and

general corporate purposes. We have broad discretion over the uses of the net proceeds and may use a portion for

the acquisition of, or investment in, technologies, solutions or businesses that complement our business although

we have no present commitments or agreements to enter into any material acquisitions or investments. There

have been no material differences between the actual use of proceeds and intended use of proceeds as originally

described in the IPO or follow-on offering. Based on our current cash and cash equivalents balance together with

cash generated from operations, we do not expect that we will have to utilize any of the net proceeds to fund our

operations during the next 12 months. Pending these uses, we intend to invest the net proceeds in short-term,

investment-grade interest-bearing securities such as money market funds, certificates of deposit, commercial

paper and guaranteed obligations of the U.S. government.

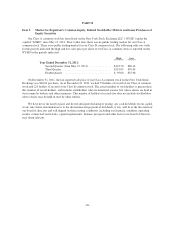

b) Issuer Purchases of Equity Securities

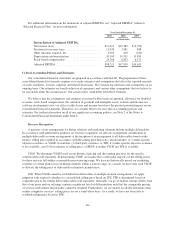

The following table provides information with respect to repurchases of unvested shares of our Class B

common stock made pursuant the 2003 Plan during the three months ended December 31, 2011. No shares of our

Class A common stock were repurchased during the period.

Period

Total

Number of

Shares

Purchased (1)

Average

Price Paid

per Share

Total

Number of

Shares

Purchased as

Part of

Publicly

Announced

Plans or

Programs

Maximum

Number of

Shares that

May Yet Be

Purchased

Under the

Plans or

Programs

October 1 – October 31, 2011 .............. — $— — —

November 1 – November 30, 2011 . . . . . . . . . . 234 8.27 — —

December 1 – December 31, 2011 .......... 2,607 7.91 — —

2,841 $7.94 —

(1) Under the 2003 Plan, participants may exercise options prior to vesting, subject to a right of a repurchase by

us. All shares in the above table were shares repurchased as a result of us exercising this right and not

pursuant to a publicly announced plan or program.

-38-