LinkedIn 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

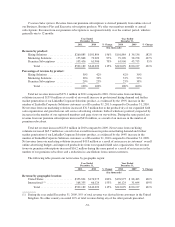

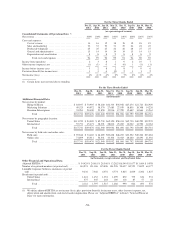

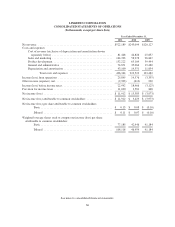

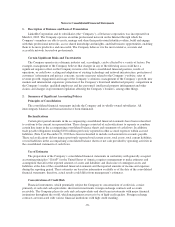

Contractual Obligations

We lease our facilities in Mountain View, California under operating leases that we expect to expire in

2023. We lease other facilities around the world, the longest of which expires in 2020. We have several material

long-term purchase obligations outstanding with third parties. We do not have any debt or material capital lease

obligations. As of December 31, 2011, the following table summarizes our contractual obligations and the effect

such obligations are expected to have on our liquidity and cash flow in future periods:

Payments Due by Period

Total

Less Than

1 Year

1-3

Years

3-5

Years

More Than

5 Years

(in thousands)

Operating lease obligations (1) ..................... $186,319 $13,767 $32,929 $33,653 $105,970

Purchase obligations (2) ........................... $ 43,161 $24,423 $18,394 $ 330 $ 14

(1) Subsequent to December 31, 2011, we leased additional facilities in various locations. The longest lease

expires in 2022 and aggregate future minimum lease payments are approximately $26.5 million.

(2) In February 2012, we entered into additional purchase commitments with a provider of data center space for

total future minimum payments of approximately $33.9 million over the next three years.

The contractual commitment amounts in the table above are associated with agreements that are enforceable

and legally binding. Obligations under contracts that we can cancel without a significant penalty are not included

in the table above.

Contingent obligations arising from unrecognized tax benefits are not included in the contractual obligations

because it is expected that the unrecognized benefits would only result in an insignificant amount of cash

payments.

Item 7A. Quantitative and Qualitative Disclosure about Market Risk

Quantitative and Qualitative Disclosure About Market Risk

We have operations both within the United States and internationally, and we are exposed to market risks in

the ordinary course of our business. These risks include primarily interest rate, foreign exchange risks and

inflation.

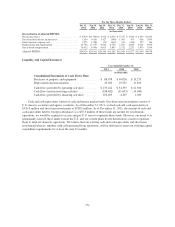

Interest Rate Fluctuation Risk

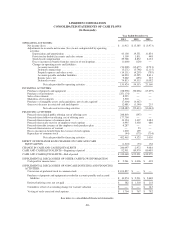

We had cash, cash equivalents, and short-term investments of $577.5 million and $93.0 million as of

December 31, 2011 and 2010, respectively. Our cash and cash equivalents consist of cash and money market

funds, which have a relatively short maturity and, as such, are relatively insensitive to interest rate changes. Our

short-term investments consist of fixed income investments, specifically U.S. treasury securities and agency

securities. Fixed income investments may have their fair market value adversely impacted by a rise in interest

rates. A hypothetical 1% (100 basis points) increase in interest rates would have resulted in a decrease in the fair

value of our investment portfolio of approximately $2.7 million as of December 31, 2011.

Foreign Currency Exchange Risk and Foreign Currency Forward Contracts

We have foreign currency risks related to our revenue and operating expenses denominated in currencies other

than the U.S. dollar, principally the British pound sterling, the euro, the Australian dollar, the Canadian dollar, and

the Indian rupee. The volatility of exchange rates depends on many factors that we cannot forecast with reliable

accuracy. We have experienced and will continue to experience fluctuations in our net income (loss) as a result of

gains (losses) related to remeasuring certain cash balances, trade accounts receivable balances and accounts payable

balances that are denominated in currencies other than the U.S. dollar. In the event our foreign currency

denominated cash, accounts receivable, accounts payable, sales or expenses increase, our operating results may be

more greatly affected by fluctuations in the exchange rates of the currencies in which we do business.

-61-