LinkedIn 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

for more information and for a reconciliation of adjusted EBITDA to net income (loss), the most directly

comparable financial measure calculated and presented in accordance with U.S. generally accepted

accounting principles, or GAAP.

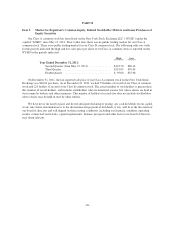

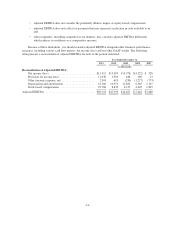

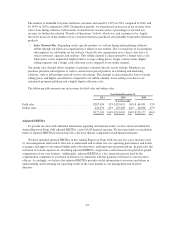

Stock-based compensation included in the statements of operations data above was as follows:

Year Ended December 31,

2011 2010 2009 2008 2007

(in thousands)

Cost of revenue ........................................ $ 1,678 $ 439 $ 370 $ 298 $ 87

Sales and marketing .................................... 8,074 1,225 657 513 163

Product development ................................... 13,625 3,248 2,346 1,214 599

General and administrative .............................. 6,391 3,920 2,779 2,580 956

Total stock-based compensation ...................... $29,768 $8,832 $6,152 $4,605 $1,805

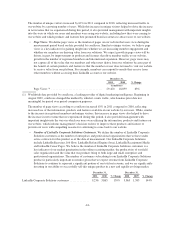

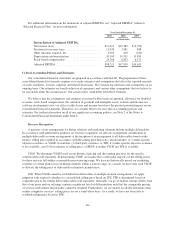

As of December 31,

2011 2010 2009 2008 2007

(in thousands)

Consolidated Balance Sheet Data:

Cash and cash equivalents ....................... $339,048 $ 92,951 $ 89,979 $ 80,495 $17,946

Short-term investments ......................... 238,456 — — — —

Property and equipment, net ...................... 114,850 56,743 25,730 21,724 9,702

Working capital ............................... 499,268 66,734 71,885 71,486 10,175

Total assets ................................... 873,697 238,188 148,559 122,062 35,162

Redeemable convertible preferred stock ............ — 87,981 87,981 87,981 12,700

Convertible preferred stock ...................... — 15,846 15,413 15,413 15,413

Total stockholders’ equity ....................... 624,979 36,249 9,082 5,230 6,589

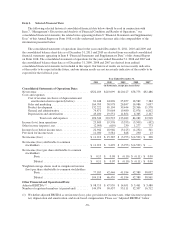

Adjusted EBITDA

To provide investors with additional information regarding our financial results, we have disclosed in the

table below and within this Annual Report on Form 10-K adjusted EBITDA, a non-GAAP financial measure. We

have provided a reconciliation below of adjusted EBITDA to net income (loss), the most directly comparable

GAAP financial measure.

We have included adjusted EBITDA in this Annual Report on Form 10-K because it is a key measure used

by our management and board of directors to understand and evaluate our core operating performance and trends,

to prepare and approve our annual budget and to develop short- and long-term operational plans. In particular, the

exclusion of certain expenses in calculating adjusted EBITDA can provide a useful measure for period-to-period

comparisons of our core business. Additionally, adjusted EBITDA is a key financial measure used by the

compensation committee of our board of directors in connection with the payment of bonuses to our executive

officers. Accordingly, we believe that adjusted EBITDA provides useful information to investors and others in

understanding and evaluating our operating results in the same manner as our management and board of

directors.

Our use of adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation

or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

• although depreciation and amortization are non-cash charges, the assets being depreciated and

amortized may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital

expenditure requirements for such replacements or for new capital expenditure requirements;

• adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

-40-