LinkedIn 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Deferred Commissions

Deferred commissions are the incremental costs that are directly associated with non-cancelable

subscription contracts primarily related to sales of the Company’s hiring solutions. Deferred commissions consist

of sales commissions paid to the Company’s direct sales representatives and are deferred and amortized over the

non-cancelable terms of the related customer contracts, which are generally 12 months. The commission

payments are generally paid in full the month after the customer contract is signed. The deferred commission

amounts are recoverable through the future revenue streams under the non-cancelable customer contracts. The

Company believes this is the preferable method of accounting as the commission charges are so closely related to

the revenue from the non-cancelable customer contracts that they should be recorded as an asset and charged to

expense over the same period that the subscription revenue is recognized. Short-term deferred commissions are

included in deferred commissions, while long-term deferred commissions are included in other assets in the

accompanying consolidated balance sheets. The amortization of deferred commissions is included in sales and

marketing expense in the accompanying consolidated statements of operations.

Derivative Financial Instruments

The Company accounts for derivative instruments and hedging activities pursuant to authoritative

accounting guidance that requires recognition of all derivatives as assets or liabilities in the statement of financial

position and measurement of those instruments at fair value. Derivatives that are not hedges must be adjusted to

fair value through earnings. If the derivative is a hedge, depending on the nature of the hedge, its change in fair

value will either be offset against the change in fair value of the hedged asset or liability, firm commitment

through earnings or recognized in other comprehensive income (loss) until the hedged item is recognized in

earnings.

The Company began to enter into forward contracts near the end of 2011 to manage currency exposure

related to net assets and liabilities denominated in foreign currencies, for certain foreign denominated assets or

liabilities. The Company does not enter into derivative financial instruments for trading purposes. As of

December 31, 2011, the Company had five outstanding forward contracts with a total notional amount of $34.1

million. These derivative instruments are not designed for hedge accounting and are adjusted to fair value

through other income (expense), net in the accompanying consolidated statements of operations. The net

unrealized gain resulting from changes in fair value of these forward contracts as of December 31, 2011 was not

material.

The gains and losses on these derivative instruments are intended to offset the impact of foreign exchange

rate changes on the underlying foreign currency denominated assets and liabilities subject to remeasurement and

transaction exposures, and therefore, these forward contracts do not subject the Company to material balance

sheet risk. As of December 31, 2011, the outstanding balance sheet hedging derivatives had maturities of less

than 30 days.

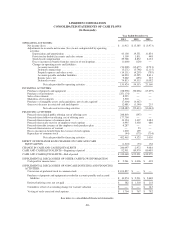

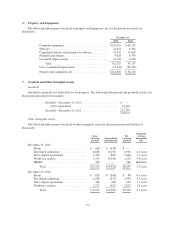

Property and Equipment

Property and equipment are stated at cost, less accumulated depreciation and amortization. Depreciation and

amortization is computed using the straight-line method over the estimated useful lives of the assets, which range

from two to five years. Leasehold improvements are amortized over the shorter of the lease term or expected

useful lives of the improvements. Depreciation expense totaled $39.5 million, $18.6 million and $11.6 million for

the years ended December 31, 2011, 2010 and 2009, respectively.

Website and Software Development Costs

The Company capitalizes its costs to develop its website and internal-use software when preliminary

development efforts are successfully completed, management has authorized and committed project funding, and

it is probable that the project will be completed and the software will be used as intended. Such costs are

-72-