LinkedIn 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

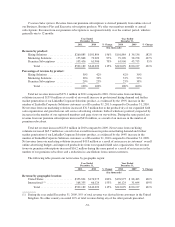

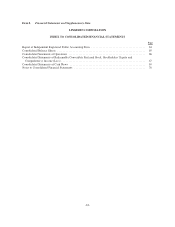

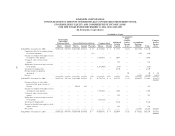

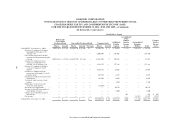

For the Three Months Ended

Dec 31,

2011

Sep 30,

2011

Jun 30,

2011

Mar 31,

2011

Dec 31,

2010

Sep 30,

2010

Jun 30,

2010

Mar 31,

2010

(in thousands)

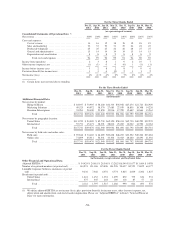

Reconciliation of adjusted EBITDA:

Net income (loss) ............................... $ 6,919 $ (1,598) $ 4,513 $ 2,078 $ 5,317 $ 3,960 $ 4,293 $1,815

Provision (benefit) for income taxes ................. 1,534 4,418 5,427 (349) 1,405 475 658 1,043

Other (income) expense, net ....................... 1,575 1,788 (11) (449) 341 (434) 357 346

Depreciation and amortization ..................... 13,784 11,555 9,602 8,159 6,565 4,845 4,201 3,940

Stock-based compensation ........................ 10,612 8,498 6,815 3,843 2,712 2,231 1,955 1,934

Adjusted EBITDA .............................. $34,424 $24,661 $26,346 $13,282 $16,340 $11,077 $11,464 $9,078

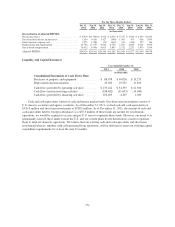

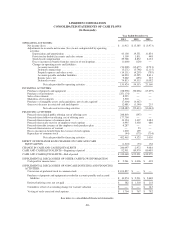

Liquidity and Capital Resources

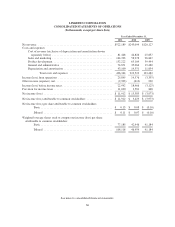

Year Ended December 31,

2011 2010 2009

(in thousands)

Consolidated Statements of Cash Flows Data:

Purchases of property and equipment ............. $ 88,978 $ 50,026 $ 13,279

Depreciation and amortization ................... 43,100 19,551 11,854

Cash flows provided by operating activities ........ $133,424 $ 54,353 $ 21,360

Cash flows used in investing activities ............ (338,482) (55,633) (13,044)

Cash flows provided by financing activities ........ 452,465 4,325 1,030

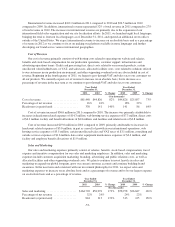

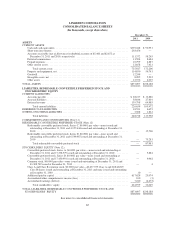

Cash and cash equivalents consist of cash and money market funds. Our short-term investments consist of

U.S. treasury securities and agency securities. As of December 31, 2011, we had cash and cash equivalents of

$339.0 million and short-term investments of $238.5 million. As of December 31, 2011, the amount of cash and

cash equivalents held by foreign subsidiaries was $53.3 million. If these funds are needed for our domestic

operations, we would be required to accrue and pay U.S. taxes to repatriate these funds. However, our intent is to

permanently reinvest these funds outside the U.S. and our current plans do not demonstrate a need to repatriate

them to fund our domestic operations. We believe that our existing cash and cash equivalents and short-term

investment balances, together with cash generated from operations, will be sufficient to meet our working capital

expenditure requirements for at least the next 12 months.

-59-