Konica Minolta 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

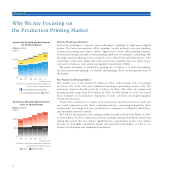

Why We Are Focusing on

the Production Printing Market

What Is Production Printing?

Production printing is a generic term referring to printing by high-speed digital

printer. The term encompasses office printing, on-site internal corporate printing,

commercial printing and what is called “digital press” in the offset printing industry.

Production printing basically is about printing small jobs on demand, contrasting with

the large runs that offset processes entail. It is also called POD, and both phrases refer

essentially to the same thing. The main production printing users are print shops,

copy service bureaus, and central reprographic departments (CRDs).

The prime advantage of production printing are as follows. (1) short-run printing,

(2) short turnaround printing, (3) variable data printing. These are the growth areas of

the market.

The Production Printing Market

This market was worth around ¥1 trillion in 2006, with in-house jobs accounting

for about 70% of the total and commercial printing representing another 20%. We

anticipate demand should reach ¥1.4 trillion by 2011. The value of commercial

printing should surge from ¥195 billion in 2006, to ¥490 billion by 2011. We based

these estimates on manufacturer shipments of units, cut-sheet, electrophotographic

system and dry toner.

Trends that enabled us to make such projections include growth in small job

runs amid expansion in the direct marketing industry, increasing demand for short

turnarounds, and rising in-house production in companies to safeguard information

and streamline internal controls.

We look for the mainstay color printing market to balloon from ¥440 billion in 2006

to ¥810 billion by 2011, while monochrome printing demand will likely remain fl at

during that period. We can capture signifi cant new opportunities in the color market

because of our highly competitive design and materials technologies, as well as our

product development and marketing foundations.

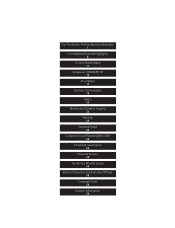

Production Printing Market Estimate

by Market Segment

0

5,00

1,000

1,500

06

95

195

670

100

490

810

07 08 09 10 11

(Cut-sheet / Based on manufacturer shipments)

Other

Corporate/in-house printing

Commercial printing

Source: Konica Minolta estimate

(Calendar years)

(Billions of Yen)

Production Printing Market Estimate

Color vs. Monochrome

(Billions of Yen)

0

500

1,000

1,500

06 07 08 09 10 11

Source: Konica Minolta estimate

(Cut-sheet / Based on manufacturer shipments)

Color Monochrome

(Calendar years)

440

520

810

590

SECTION I

4